- Quantum & Chips

Nvidia CEO to Meet Chinese Officials Amid $50 Billion Market Loss

5 minute read

Nvidia’s AI chip restrictions in China force strategic pivot as domestic competitors gain market share amid export controls

Key Takeaways

- $50 billion China market effectively closed: Nvidia faces $8 billion in second-quarter sales losses due to U.S. export controls on advanced AI chips, forcing the company to develop China-specific alternatives.

- Market share plummets from 95% to 50%: Nvidia’s dominance in China’s AI chip market has been cut in half over four years as local competitors like Huawei fill the void left by restricted U.S. technology.

- Historic $4 trillion market cap achieved: Despite China challenges, Nvidia becomes the first company to close trading above $4 trillion valuation, driven by global AI demand and $61.26 billion in U.S. revenue.

Introduction

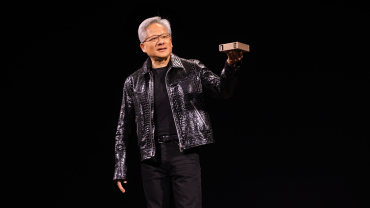

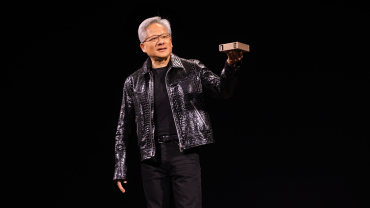

Nvidia CEO Jensen Huang prepares to meet with top Chinese officials in Beijing next week as the company navigates a complex balancing act between accessing the world’s largest AI market and complying with U.S. export restrictions. The visit comes as Nvidia reports record global sales despite losing billions in Chinese revenue to trade controls.

The timing proves particularly significant as Huang recently met with President Trump at the White House before his planned China trip. This diplomatic juggling act highlights the pressures facing American tech companies operating at the intersection of cutting-edge technology and intensifying geopolitical tensions.

Key Developments

Nvidia has developed China-specific AI chips to comply with U.S. export restrictions while maintaining market presence. The company now offers a modified Blackwell RTX Pro 6000 that removes high-bandwidth memory and NVLink capabilities, allowing continued sales within regulatory constraints.

The company previously excluded China from revenue forecasts due to export bans but now attempts to re-integrate the market into business planning. This strategic reversal signals renewed commitment to capturing Chinese demand despite regulatory hurdles.

Huang’s Beijing meetings will focus on AI cooperation and technology development, with expected participation in the China International Supply Chain Promotion Expo. According to The Information, discussions will include senior officials such as China’s commerce minister.

Market Impact

China revenue dropped to $17.11 billion in fiscal 2025, representing just 13.1% of total revenue compared to 26.4% in 2022. This decline reflects both export restrictions and increased competition from domestic Chinese firms.

Despite China challenges, Nvidia’s overall performance remains robust. U.S. revenue surged to $61.26 billion in 2025, while data center revenues reached $35.6 billion in Q4 alone, driven by AI and accelerated computing demand.

The company recently achieved a historic milestone, becoming the first to close trading with a market capitalization exceeding $4 trillion. This valuation surpasses tech giants Apple and Microsoft, demonstrating strong investor confidence in Nvidia’s global AI leadership.

Strategic Insights

Nvidia’s China strategy reveals broader trends in global technology fragmentation. Companies increasingly customize products for specific regulatory environments, balancing compliance requirements with commercial opportunities.

The competitive landscape shifts as Chinese firms rapidly develop indigenous capabilities. Local champions like Huawei’s HiSilicon gain market share while reducing dependence on U.S. technology, accelerating the rise of domestic alternatives.

Export controls create unintended consequences by spurring innovation among restricted markets. China’s AI hardware development accelerates as companies seek alternatives to U.S. suppliers, potentially creating stronger long-term competition for American firms.

Expert Opinions and Data

Several analysts maintain strong buy ratings on Nvidia, arguing that China’s limited impact on overall results justifies optimism. The company’s dominance in global AI hardware markets provides resilience against regional challenges.

However, skeptics warn about risks from further U.S. government intervention or antitrust scrutiny. Some analysts question whether maximizing Chinese revenue justifies potential regulatory backlash or competitive acceleration.

Industry observers interpret Huang’s planned meetings as bold signaling of market commitment. The approach represents both pragmatic adaptation to constraints and potential catalyst for increased Chinese innovation investment.

Conclusion

Nvidia’s diplomatic engagement with Chinese officials underscores the complex navigation required between technological leadership and geopolitical realities. The company maintains strong global positioning while adapting to regulatory fragmentation across key markets.

The strategy reflects broader industry trends toward regional customization and localized compliance. Nvidia’s ability to balance U.S. regulatory requirements with international market access demonstrates the evolving nature of global technology competition in the AI era.