- FinTech

- Investing

How Religion’s $5 Trillion

Is Reshaping the Future of Tech

12 minute read

With Mormon Megafunds And Islamic Fintech at the Helm, Faith-Based Investors Are Quietly Reshaping Silicon Valley.

In an increasingly digitized world, religion is not just keeping up—it’s investing, innovating, and in some cases, leading. Religious practice is no longer confined to temples, churches, synagogues, or mosques—it now thrives in the palms of billions. From daily scripture reminders to virtual prayer circles, faith-based apps are reshaping how spiritual communities engage, worship, and even tithe.

Research shows that more than a fifth of US adults utilize mobile apps for scripture reading and other religious content, while around 16% of US adults engage weekly with at least two types of religious technology, such as scripture reading apps, prayer reminders, or religious podcasts.

Behind this surge in spiritual software lies a powerful blend of belief and business. Major venture capital firms, including a16z (Andreessen Horowitz), have recognized the growth potential of religious tech, pouring millions into platforms that merge ancient traditions with cutting-edge innovation. These apps monetize through donations, subscriptions, e-commerce, data insights, and partnerships with religious institutions, while also attracting the attention—and capital—of heavyweight financial players

The Rise of Religious Apps

Scroll through any app store today and you’ll find more than just games and productivity tools—you’ll discover a growing collection of religious apps, from digital rosaries to Quran study tools.

Among the most prominent is YouVersion’s Bible App, which has earned the title of most downloaded religious app in history after surpassing 600 million downloads globally. Initially launched as a nonprofit initiative, the Bible App’s scale and data-driven insights into global spiritual engagement have turned it into a case study of tech-savvy evangelism. Developed by Life.Church, Bible App offers a completely free, ad-free experience. While it doesn’t rely on traditional monetization strategies like subscriptions or advertising, it receives donations and anchors its reach for broader digital ministry initiatives.

The success of Bible App has sparked a wave of similar apps across different faiths.

Glorify, a Christian meditation app focused on daily devotionals and prayer, has raised over $40 million in venture funding, including investment from a16z (Andreessen Horowitz). The app offers freemium features and operates more like a wellness and mindfulness platform, blending spiritual nourishment with the user experience of a tech startup.

Islamic digital platforms have followed a similar trajectory. Muslim Pro, which offers Quran readings, prayer notifications, and fasting times, is one of the most popular apps in the Muslim world, with over 170 million downloads. Innovations have spanned beyond traditional apps, however. There’s also a rise in Sharia-compliant investment apps and donation platforms that track Zakat using blockchain technology, and even halal crypto solutions that offer investment opportunities that comply with Islamic law.

In Hinduism, large spiritual movements such as the Isha Foundation and the Art of Living have built digital ecosystems around their teachings, with apps that offer guided meditations, paid courses, and live broadcasts of spiritual sessions. These organizations often operate extensive digital donation systems and merchandise stores linked to major religious festivals like Diwali and Navratri.

With its long tradition of textual scholarship, Judaism has embraced digital platforms like Sefaria, which provides free access to Jewish texts and commentaries. While the platform is non-commercial, it supports its operations through donations and philanthropic partnerships. Other Jewish apps offer paid access to classes, lifecycle event services like bar/bat mitzvah preparation, and synagogue management software. Synagogues increasingly rely on platforms that handle everything from membership billing to Torah reading schedules, often operating as subscription-based SaaS companies. These digital trends are mirrored by a broader financial phenomenon: religious institutions themselves are becoming significant investors in the tech sector

Faith & Finance

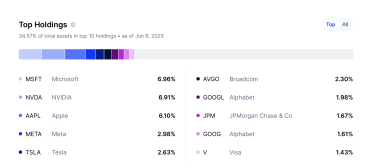

Across various traditions, these institutions control vast financial portfolios. The Church of Jesus Christ of Latter-day Saints manages an estimated $100 billion in assets through Ensign Peak Advisors, investing heavily in major technology stocks such as Apple, Google, and Nvidia. The Catholic Church, which holds extensive global real estate and financial holdings, has backed several digital evangelism and education platforms. Hindu temples and ashrams, particularly in India and North America, operate charitable trusts that fund technological and educational initiatives. Jewish philanthropic organizations have launched tech incubators focused on innovation in Jewish education, culture, and engagement.

A recent study by the University of Oxford’s Saïd Business School puts the global assets managed by religious institutions at over $5 trillion, a scale that positions faith-based capital as a global macroeconomic force, on par with the GDP of major nations. Notably, Islamic finance leads with US $4 trillion, followed by Dharmic (US $300 billion), Christian (US $260 billion), and Jewish finance (US $16 billion). These institutions are not limiting their investments to mainstream platforms–many are moving into emerging technologies, with cryptocurrency and blockchain drawing particular interest.

Some churches have begun accepting donations in Bitcoin and Ethereum, while the Vatican has explored tokenizing digital assets for its vast historical archives. In the Islamic world, blockchain is seen as a tool for improving financial transparency and compliance with religious financial principles, especially in distributing Zakat.

Artificial intelligence is another frontier. According to Pushpay’s 2025 State of Church Tech report, 45% of over 1,700 surveyed church leaders now utilize AI, marking an 80% increase from the previous year. These technologies assist in tasks such as content creation, graphic design, and sermon development. Religious institutions are also investing in venture capital firms and exchange-traded funds (ETFs) with exposure to AI, healthtech, and fintech startups.

Religious practice is no longer confined to temples, churches, synagogues, or mosques—it now thrives in the palms of billions.

Their focus is not only on financial return but also on shaping ethical frameworks for these technologies. Catholic universities have been involved in AI ethics initiatives, and Jewish and Islamic scholars are developing religious perspectives on algorithmic fairness, digital personhood, and data privacy. These institutions are helping frame conversations about how technology should serve humanity, not just how it can profit from it.

Religious organizations are also supporting the development of alternative digital platforms that align more closely with their values. In response to concerns about content moderation and ideological bias on mainstream platforms, some groups have begun building their own social media networks, streaming services, and community hubs.

Pray.com, for example, was launched by American entrepreneur Steve Gatena and three co-founders in 2017 as a faith-based social networking platform designed to connect Christians worldwide. The app, which offers features such as daily prayers, sermons, and community groups, gained significant popularity during the COVID-19 pandemic, with a 955% surge in downloads, as users sought virtual ways to engage with their faith. This move toward digital sovereignty reflects a desire not just for free expression but for digital infrastructure rooted in theological and ethical priorities.

However, as religious institutions deepen their ties with technology, the implications are profound. These organizations are not just consumers or benefactors of digital innovation—they are shaping its direction. By funding startups, influencing ethical norms, and mobilizing global faith communities, religion is becoming a central force in the evolving tech economy. It’s clear that the future of technology will not be shaped solely by engineers and entrepreneurs, but also by clergy, monks, scholars, and believers navigating the digital age with millennia of spiritual wisdom.

In this new landscape, questions of privacy, profit, and purpose are more intertwined than ever. What does it mean for a prayer app to track user behavior? Should religious institutions profit from AI-driven engagement? And how will sacred values inform secular algorithms? As faith and finance continue to converge, the answers will define the next chapter of the digital revolution—not just in terms of technology, but in terms of meaning.

Data, Ethics, and the Future

With faith-based apps collecting sensitive personal data, like location, habits, prayer times, and mental health, the ethical stakes are high. While many apps emphasize privacy and data security–YouVersion maintains a strict policy against selling user data or incorporating advertisements.

Hallow, a Catholic meditation and prayer platform that has raised more than $100 million from investors including Peter Thiel, is also known to collect various types of user data, including encrypted journal entries, prayer durations, and optional religious beliefs shared during onboarding or surveys.

The fusion of religion and tech must therefore navigate not only monetization but also privacy, consent, and theological boundaries.

Currently, religious institutions’ approach to applying ethical filters to tech portfolios varies widely. Some institutions, particularly within Catholic, Jewish, and Islamic traditions, have established clear ethical investment guidelines rooted in their theological values. These guidelines may exclude companies involved in pornography, weapons, gambling, or exploitative labor, and increasingly consider emerging issues such as AI ethics, surveillance, and data privacy.

For example, Catholic organizations like the U.S. Conference of Catholic Bishops publish socially responsible investment guidelines, and Islamic finance mandates Sharia compliance, avoiding interest-based financial systems and unethical sectors. Jewish philanthropic funds prioritize education, healthcare, and justice-oriented startups aligned with Tikkun Olam, the principle of repairing the world.

The aforementioned research out of Oxford’s Saïd Business Schoolalso underscores the potential of faith-based capital to address complex global challenges, aligning with the values and goals of faith communities worldwide. With over 85% of the global population affiliated with a faith, mobilising this capital is seen as a “game-changer” in achieving the UN Sustainable Development Goals

However, many religious institutions—especially those managing large funds—do not consistently apply these values across tech holdings. Large investment portfolios often mirror mainstream funds, with exposure to big tech, AI firms, and platforms that may conflict with religious teachings on community, privacy, or well-being.

CATH / S&P 500 / Top Holdings

While clear risk to ethics, a recent paper out of Cornell shows that AI, when thoughtfully applied, has the potential to be an ethical tool in its own right. While values-based investing, particularly within faith communities, has faced challenges in aligning moral constraints with financial returns, the study addresses that gap by employing LLMs to identify and optimize investment portfolios that adhere to specific ethical guidelines.Using the Global X S&P 500 Catholic Values ETF (CATH) as a case study, the authors developed “synthetic CATH” portfolios. These portfolios were constructed by analyzing textual data to identify companies aligning with Catholic values, and then optimized using and then optimized using Deep Reinforcement Learning (DRL) to maximize risk-adjusted returns. The results showed significant improvements in performance, effectively narrowing the gap between ethical constraints and financial objectives. While this research shows that obstacles can be overcome, the challenge of aligning financial performance with moral accountability remains for religious institutions. As technology shapes society at a foundational level, the lack of consistent ethical screening raises questions about whether faith-based investors are truly stewarding capital in line with their spiritual commitments.