- AI and Robotics

- Corporate Governance

- Executive Compensation

Tesla Sets $7.5 Trillion Value Goal in Musk Compensation Package

6 minute read

Tesla’s CEO compensation plan challenges industry norms as board targets unprecedented market growth through AI and robotics expansion

Key Takeaways

- $7.5 trillion value creation target: Tesla proposes unprecedented CEO compensation requiring Musk to grow the company’s market cap from $1 trillion to over $8 trillion over the next decade.

- $24 billion interim award approved: Tesla’s board grants Musk a “good faith payment” of 96 million shares while his 2018 compensation package remains under legal appeal in Delaware courts.

- 25% voting control potential: If all milestones are achieved, Musk could receive over 423 million additional shares, increasing his Tesla ownership to approximately 25% and potentially making him the world’s first trillionaire.

Introduction

Tesla has unveiled the most ambitious CEO compensation package in corporate history, requiring Elon Musk to generate nearly $7.5 trillion in shareholder value to earn the full award. The proposed plan ties Musk’s potential payout to aggressive growth targets that would transform Tesla from its current $1 trillion valuation to over $8 trillion within a decade.

This compensation structure represents a fundamental shift in executive pay design, addressing previous shareholder concerns while setting operational milestones that include launching 1 million Robotaxis and delivering 1 million AI Bots. The plan emerges as Tesla positions itself beyond electric vehicles into artificial intelligence and robotics.

Key Developments

Tesla’s board announced the 2025 CEO Performance Award following ongoing legal challenges to Musk’s 2018 compensation plan. According to CNBC, Delaware courts have twice struck down the previous package, citing insufficient shareholder disclosure and concerns over Musk’s influence in the approval process.

The new structure requires Musk to meet operational targets that are 28 times greater than the 2018 award’s EBITDA requirements. Key milestones include delivering 20 million Tesla vehicles cumulatively and achieving 10 million active Full Self-Driving subscriptions.

Tesla’s board simultaneously approved a $24 billion interim stock award, described as a “first step, good faith payment” to retain Musk’s engagement during the legal proceedings. These restricted shares vest only if Musk remains with Tesla until August 2027 and cannot be sold until 2030.

The company has relocated its corporate registration from Delaware to Texas, seeking to leverage Texas’ corporate governance framework for future shareholder decisions. This move aims to mitigate risks from potential activist shareholders and judicial interference.

Market Impact

The compensation proposal sets milestone tranches starting at $2 trillion market capitalization and culminating at $8.5 trillion. For context, Tesla would need to surpass current tech giants including Nvidia ($4.2 trillion), Microsoft ($3.8 trillion), and Apple ($3.6 trillion) to achieve these targets.

If successful, Musk could earn $900 billion in Tesla stock, positioning him as the world’s first trillionaire. However, the plan’s structure ensures that if Tesla’s stock depreciates significantly, Musk receives no compensation, directly aligning his outcomes with shareholder returns.

The share dilution impact remains significant, with over 423 million potential new shares for Musk representing substantial ownership redistribution. This dilution only occurs if Tesla achieves unprecedented value creation, theoretically benefiting existing shareholders despite reduced percentage ownership.

Strategic Insights

Tesla’s compensation strategy reflects broader tech industry trends toward incentivizing transformative leadership while managing executive retention risks. The plan addresses Musk’s involvement in other ventures like Neuralink and The Boring Company by creating substantial financial incentives for Tesla focus.

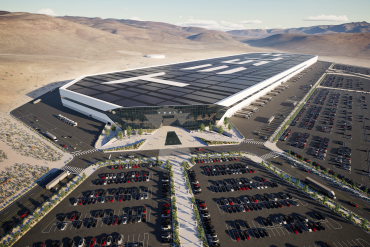

The operational milestones signal Tesla’s strategic pivot beyond electric vehicles into autonomous transportation and artificial intelligence. The Robotaxi deployment target and AI Bot production requirements indicate Tesla’s positioning at what the board describes as a “critical inflection point.”

This approach mirrors successful tech industry precedents where visionary leaders receive equity-heavy compensation tied to company transformation. The scale, however, exceeds any previous executive compensation arrangement, reflecting both Tesla’s ambitions and current market valuations in the AI and autonomous vehicle sectors.

Expert Opinions and Data

Tesla Chair Robyn Denholm emphasizes that retaining Musk remains “fundamental to achieving Tesla’s historic ambitions.” Board member Kathleen Wilson-Thompson reinforces this position, stating that Musk’s leadership is vital to Tesla’s goal of becoming “the most valuable company in history.”

Industry analysts express mixed reactions to the proposal’s audacious scale. Many view the targets as extremely ambitious given current market conditions and Tesla’s recent challenges in its core automotive business. Corporate governance experts raise concerns about concentrating additional voting power in Musk’s hands, particularly following judicial criticism of the previous compensation structure.

Tesla’s recent operational achievements support the board’s confidence, including delivery of its 8 millionth vehicle and deployment of over 37 GWh of energy storage from Q3 2024 to Q2 2025. The company launched its first Robotaxis in Austin, Texas, in June and secured strategic partnerships with Samsung for enhanced chip production.

The compensation plan references Musk’s “Master Plan, Part IV,” focusing on “Sustainable Abundance” through AI integration across Full Self-Driving, Optimus robotics, and Robotaxi services. This strategic framework guides Tesla’s expansion beyond traditional automotive markets.

Conclusion

Tesla’s proposed compensation package represents the highest-stakes executive incentive structure in corporate history, requiring unprecedented value creation to justify equally unprecedented rewards. The plan’s success depends on Tesla’s ability to execute transformative advances in robotics, artificial intelligence, and sustainable technology.

Shareholders will vote on the proposal at Tesla’s annual meeting this November, determining whether to approve a compensation structure that could either validate extraordinary corporate ambition or establish new standards for executive pay excess. The outcome establishes critical precedents for how public companies balance visionary leadership retention with shareholder value protection.