- Geopolitics & Policy

- Global Trade

- Semiconductors

Nvidia Halts China-Specific H20 Chip Production Amid Crackdown

6 minute read

Nvidia’s chip production freeze amid Chinese security concerns threatens $8 billion in global semiconductor revenue

Key Takeaways

- Nvidia halts H20 chip production following Beijing’s security crackdown, instructing suppliers including Samsung and Amkor Technology to pause manufacturing for the China-specific semiconductors.

- $8 billion revenue loss anticipated as Nvidia excludes China from future financial forecasts amid escalating U.S.-China tech tensions and export restrictions.

- Chinese tech giants ordered to cease purchases of H20 chips, with ByteDance, Alibaba, and Tencent receiving Beijing directives to halt orders over national security concerns.

Introduction

Nvidia faces a significant disruption to its China operations as the semiconductor giant suspends production of H20 chips designed specifically for the Chinese market. The company recently instructed key suppliers, including Arizona-based Amkor Technology and South Korea’s Samsung Electronics, to halt manufacturing activities related to these semiconductors.

This production freeze responds directly to Beijing’s intensified scrutiny over alleged security risks in the chips. The H20 represents a China-specific product intentionally limited to 15% of Nvidia’s flagship H100 computing power to comply with U.S. export controls while preventing advanced AI development capabilities.

Key Developments

The crisis escalated when China’s Cyberspace Administration summoned Nvidia last month over national security concerns. Beijing expressed fears that the chips contain potential tracking technology or “backdoors” that could compromise Chinese systems.

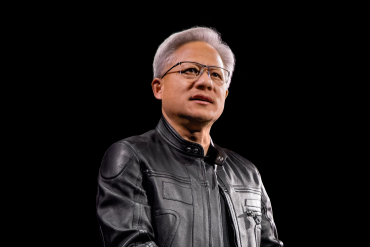

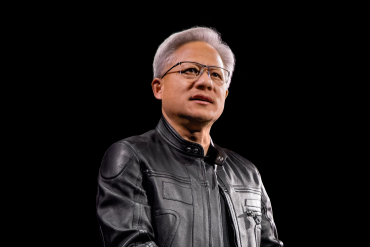

Nvidia CEO Jensen Huang addressed these concerns directly during meetings in Taiwan, assuring Chinese authorities that no such backdoors exist in the H20 chips. The company maintains ongoing discussions with Beijing to resolve the security questions, which Huang acknowledged as unexpected.

According to CNBC, the production halt extends beyond Samsung and Amkor, with reports indicating Foxconn also received instructions to suspend related manufacturing work. This coordinated pause across multiple suppliers demonstrates the scope of Nvidia’s response to Chinese regulatory pressure.

The timing proves particularly challenging as U.S. export licenses had recently allowed H20 shipments to resume after an effective ban implemented in April. Nvidia agreed to a 15% export tax on chips sold to China as part of negotiations to restart sales.

Market Impact

The financial implications extend far beyond production costs, with Nvidia anticipating an $8 billion revenue loss in Q2 2025. The company has excluded China from future financial forecasts, signaling a fundamental shift in its global strategy.

Industry competitors face similar pressures, with AMD reporting an $800 million inventory write-down and 31% drop in net income during Q2 2025. These figures illustrate the broader financial toll that export controls impose across the semiconductor sector.

The production halt affects major Chinese technology companies directly, as ByteDance, Alibaba, and Tencent received Beijing directives to cease H20 chip orders entirely. This coordinated action removes substantial demand from Nvidia’s pipeline and creates immediate supply chain disruptions.

Strategic Insights

Beijing’s actions reinforce its strategic push toward semiconductor self-sufficiency, reducing dependence on American AI hardware. This shift accelerates Chinese investment in domestic chip design and manufacturing capabilities, potentially creating long-term competitive challenges for U.S. firms.

Nvidia responds by developing the B30A chip, a diluted version of its Blackwell B300 architecture. This product strategy highlights the company’s attempts to navigate increasingly fragmented global markets while maintaining compliance with evolving export restrictions.

The crisis exposes the fragility of cross-border semiconductor trade in an era of heightened geopolitical tensions. Companies across the industry must now factor regulatory risk into strategic planning, often requiring parallel product lines for different markets.

Expert Opinions and Data

Industry analysts interpret Beijing’s stance as resistance to U.S. efforts to maintain American AI hardware dominance in Chinese markets. The coordinated nature of the crackdown suggests systematic policy implementation rather than isolated regulatory action.

Nvidia emphasizes in official statements that H20 chips qualify as commercial rather than military products. The company maintains that balanced chip sales between the U.S. and China benefit global commercial practices, despite mounting political pressures.

Critics of current U.S. export policy warn that using technology restrictions as bargaining chips in broader trade negotiations risks undermining both national security objectives and economic interests. Some analysts argue that widespread chip sale restrictions may push international customers toward alternative suppliers, ultimately limiting American firms’ global market opportunities.

Conclusion

The H20 production halt represents a critical inflection point in semiconductor industry dynamics, demonstrating how quickly geopolitical tensions can disrupt established supply chains and business relationships. Nvidia’s decision to exclude China from financial forecasts reflects the uncertainty surrounding future market access.

The crisis underscores the complex intersection of business strategy, regulatory compliance, and geopolitical risk in the global technology sector. As tech decoupling accelerates, companies must develop more resilient strategies for navigating fragmented markets while maintaining innovation capabilities across restricted regions.