- Cross-Border Payments

- Digital Banking

- FinTech

Wise and Revolut Redefine Cross-Border Payments in 2025

5 minute read

Cross-border payments platform Wise drives financial innovation as transaction volumes surge 23% amid fintech expansion

Key Takeaways

- Wise moves £145.2 billion across borders in FY2025, marking a 23% year-on-year increase as the company reports revenue of £1.21 billion and customer balances totaling £17.1 billion.

- Revolut records $2.1 billion revenue with $180 million profit, achieving a 22% increase in company valuation while expanding its super-app financial platform beyond basic transfers.

- 65% of Wise payments deliver in under 20 seconds, highlighting how fintech speed and transparency are reshaping international money transfers away from traditional banking systems.

Introduction

Two fintech giants are transforming how businesses and consumers move money across borders, moving beyond simple transfer services to become comprehensive financial platforms. Wise and Revolut have emerged as dominant forces in international payments, collectively processing billions in transactions while expanding into banking, investing, and business services.

The companies represent distinct approaches to fintech growth. Wise focuses on transparent, low-cost international transfers with fees starting from 0.4%, while Revolut pursues a super-app strategy offering banking, investment, and insurance services through tiered subscription models.

Key Developments

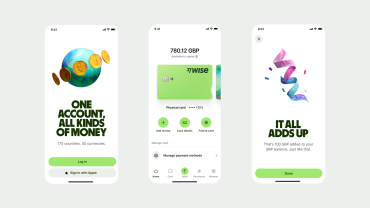

Wise has evolved significantly since its 2011 founding as TransferWise, initially targeting personal users before expanding into B2B payments. The company now offers multi-currency accounts supporting 40+ currencies with local account details in nine major markets including GBP, USD, and EUR.

Recent product expansions include Wise Assets, enabling customers to invest in stocks, bonds, and funds directly through the platform. The company’s business accounts provide no monthly fees and major local account details for a one-time fee, targeting SMEs and enterprises.

Revolut follows a different trajectory with its comprehensive financial ecosystem. The platform supports 25+ currencies and provides local account details in three major currencies, while offering fixed and flexible forward contracts for currency risk management.

Market Impact

Wise’s FY2025 results demonstrate strong market performance with customer balances reaching £17.1 billion, up 29% year-on-year. Interest income rose to £594.3 million, reflecting the company’s solid financial health and growing customer deposits.

Revolut’s financial metrics show similar strength with significant revenue generated from subscription plans and cross-border payments. The company’s tiered pricing model ranges from €10 for basic services to custom enterprise-level packages.

Both platforms maintain identical customer satisfaction ratings of 4.3/5 on Trustpilot, indicating strong user loyalty despite their different service approaches. The latest quarterly figures show Wise achieving a 10% increase compared to the previous fiscal year.

Strategic Insights

The companies employ contrasting expansion strategies that reflect broader fintech sector trends. Wise specializes in local-to-local transfers through partnership networks, maintaining low fees while ensuring regulatory compliance across multiple jurisdictions.

Revolut’s broader product offering necessitates slightly higher fees to support its comprehensive service range, but creates multiple revenue streams and customer touchpoints. This super-app approach positions the company to capture more customer lifetime value.

Both platforms target international businesses with competitive exchange rates and multi-currency capabilities. Wise Business accounts integrate with major accounting tools including Xero, QuickBooks, and Sage, while Revolut Business offers flexible subscription packages with cashback and business debit cards.

Expert Opinions and Data

Industry analysis reveals that building large fintech ecosystems creates significant monetization opportunities, evident in both companies’ robust revenue growth patterns. The sector benefits from consumers seeking alternatives to traditional banking fees and processing times.

Technology remains crucial for competitive advantage, with Wise delivering 65% of payments in under 20 seconds. This speed advantage, combined with transparent fee structures, appeals to businesses requiring predictable international payment costs.

Regulatory frameworks continue adapting to support fintech expansion while ensuring consumer protection. Cross-border transaction regulations pose ongoing challenges due to heightened financial crime risks, requiring sophisticated compliance systems.

Security measures differentiate the platforms’ market positioning. Wise operates as a registered Money Services Business with major financial regulators, using anti-fraud teams and AI for transaction security. Revolut holds an ECB banking license and offers FDIC insurance in the US alongside advanced security features.

Conclusion

Wise and Revolut represent the maturation of fintech from simple money transfer services to comprehensive financial platforms. Their strong financial performance and expanding service offerings demonstrate successful monetization of international payment flows.

The companies’ growth trajectories highlight the sector’s potential as traditional banking systems face increasing competition from digital-first alternatives. Both platforms continue expanding internationally while navigating complex regulatory environments that govern cross-border financial services.