- Global Trade

- Macro & Policy

- Semiconductors

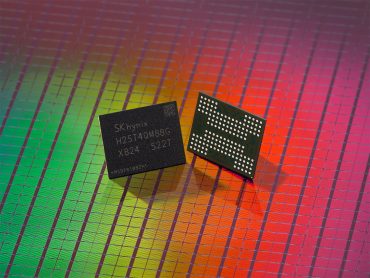

US Revokes Samsung, SK Hynix Approvals for China Operations

5 minute read

US semiconductor restrictions hit Samsung and SK Hynix manufacturing operations as Chinese factory activity reaches new highs

Key Takeaways

- Samsung and SK Hynix shares tumble 2.5% and 4.5% after US Commerce Department revokes semiconductor equipment approvals for their China operations, threatening production in the world’s largest chip market.

- Hong Kong’s Hang Seng surges 2% while Japan’s Nikkei drops 2% as Chinese factory activity reaches five-month highs, creating divergent regional performance amid US tech sector weakness.

- Tech sector maintains 38.1% year-to-date gains despite Monday’s Asian selloff, with AI spending projected to grow at 29% annually through 2028 supporting long-term sector fundamentals.

Introduction

Asian markets delivered mixed signals Monday as geopolitical tensions and economic data created sharp divergences across the region. Japan’s Nikkei 225 plunged 2% while Hong Kong’s Hang Seng surged 2%, reflecting investors’ conflicting reactions to US semiconductor restrictions and encouraging Chinese manufacturing data.

The US Commerce Department’s decision to remove Samsung Electronics and SK Hynix from authorized entity lists sent shockwaves through Northeast Asian tech markets. Meanwhile, a private survey showing Chinese factory activity at five-month highs provided a counterweight to regional pessimism.

Key Developments

US authorities revoked semiconductor equipment approvals for Samsung and SK Hynix operations in China, directly impacting the companies’ ability to supply their Chinese manufacturing facilities. Samsung shares fell 2.5% in Seoul trading while SK Hynix dropped 4.5%, leading South Korea’s KOSPI index down 1.1%.

Japan’s technology sector faced broader pressure from Friday’s US tech selloff. Advantest Corp tumbled over 9% and SoftBank Group declined nearly 7%, contributing to the Nikkei’s sharp decline. The broader TOPIX index showed more resilience with a smaller 0.8% drop.

China’s private manufacturing PMI data provided the session’s positive surprise, indicating factory activity expanded at its fastest pace in five months. This contrasted with official readings showing five consecutive months of contraction, though investors focused on the private survey’s more optimistic assessment.

Market Impact

Regional equity performance split along geographic lines, with Northeast Asian markets declining while Chinese and Hong Kong indices advanced. MSCI’s Asian shares gauge fell 0.4% as technology-heavy markets underperformed.

Hong Kong emerged as the session’s standout performer, with the Hang Seng rising 1.8% as investors interpreted Chinese manufacturing data as signaling industrial demand recovery. Companies including Xiaomi and Lenovo posted gains, suggesting renewed confidence in specific technology leaders.

Commodity markets reflected the mixed sentiment, with Brent crude falling 1.1% after posting its first monthly loss since April. The dollar remained steady while US stock futures showed modest gains, with S&P 500 contracts up 0.2% and Nasdaq 100 futures advancing 0.3%.

Strategic Insights

The semiconductor equipment restrictions highlight growing bifurcation in global technology supply chains. Samsung and SK Hynix face operational constraints that could accelerate their relocation of advanced manufacturing outside China, potentially reshaping industry geography over the coming years.

Chinese manufacturing data suggests domestic demand stabilization despite ongoing external pressures. The divergence between official and private PMI readings reflects measurement differences but indicates underlying industrial activity remains above contraction levels.

Technology sector fundamentals remain supportive despite near-term volatility. Global IT spending projects 9.3% growth in 2025, with AI-related investments driving double-digit expansion in data center and software segments.

Expert Opinions and Data

“While a possible step towards no (or fewer, or lesser) tariffs would be positive for global trade and risk sentiment, uncertainty has ratcheted up a notch,” ANZ Group Holdings analysts including David Croy wrote in a note to clients. Their assessment reflects broader market concerns about trade policy unpredictability.

The technology sector’s 38.1% year-to-date gain in 2024 demonstrates continued investor confidence despite periodic setbacks. AI spending maintains a projected 29% compound annual growth rate through 2028, supporting sector expansion beyond current market turbulence.

Alibaba’s revenue surge from China’s AI boom exemplifies how companies are monetizing artificial intelligence investments. The company’s 19% share price jump following earnings demonstrates investor appetite for AI-focused growth stories remains intact.

Conclusion

Monday’s trading session encapsulates the complex dynamics facing Asian technology markets as geopolitical restrictions collide with improving economic fundamentals. Semiconductor companies confront immediate operational challenges while broader technology trends support medium-term growth prospects.

The sharp performance divergence between Northeast Asian and Chinese markets signals investor differentiation based on regional exposure and policy impacts. Technology sector fundamentals remain robust despite near-term headwinds from trade restrictions and market volatility.