- Earnings Season

- Semiconductors

- Stock Market

TSMC Revenue Hits Record $31.9 Billion on AI Chip Demand

5 minute read

Global semiconductor demand propels TSMC’s quarterly revenue to record highs as AI chip production accelerates worldwide

Key Takeaways

- TSMC reports 39% revenue surge to $31.93 billion in Q2 2025, driven by AI chip demand as the company projects $114 billion in full-year revenue

- Asian markets trade flat amid tariff uncertainty as President Trump’s August 1 deadline approaches, with chipmaking stocks underperforming following ASML’s 2026 growth warning

- Australia’s ASX 200 jumps 0.7% near record highs after weak employment data increases expectations for additional RBA interest rate cuts

Introduction

Asian markets struggle to find direction as investors navigate mounting uncertainty over U.S. trade tariffs and Federal Reserve policy. Most regional indices trade flat-to-low on Thursday, with chipmaking stocks particularly weak ahead of critical earnings from Taiwan Semiconductor Manufacturing Company (TSMC).

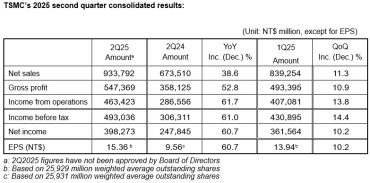

The semiconductor giant reports second-quarter revenue of $31.93 billion, marking a 39% year-over-year increase driven by surging artificial intelligence demand. TSMC’s performance carries significant weight across Asian tech markets, as the world’s largest contract chipmaker supplies critical components to major players including Nvidia, Apple, and AMD.

Key Developments

President Trump’s clarification that he does not plan to fire Federal Reserve Chair Jerome Powell provides limited market relief. The president maintains criticism of Powell while demanding immediate rate cuts, creating ongoing policy uncertainty that weighs on investor sentiment.

Trade tensions escalate as Trump’s August 1 tariff deadline approaches without extension plans. The administration proposes a 200% tariff on pharmaceutical imports, raising inflation concerns despite softer-than-expected producer price data. These developments compound existing tariffs on steel and automobiles that continue to impact Japanese export figures.

TSMC’s earnings take center stage following ASML Holding’s warning about revenue growth challenges for 2026. The Dutch equipment maker’s cautious outlook spooked U.S. chip stocks, despite strong AI-driven demand supporting current performance.

Market Impact

Regional indices reflect the cautious sentiment, with Japan’s Nikkei 225 declining 0.3% and South Korea’s KOSPI dropping 0.4%. The MSCI Asia-Pacific index outside Japan manages only a 0.06% gain, while Chinese markets show modest strength with small gains in the Shanghai Composite and CSI 300.

Semiconductor stocks face particular pressure, with SK Hynix plunging over 8% after a Goldman Sachs downgrade. Tokyo Electron and Advantest each fall 2%, while TSMC shares decline 0.9% in Taiwan trading despite strong earnings results.

U.S. futures signal continued weakness, with S&P 500 contracts down 0.2% to 6,292.50 points and Nasdaq 100 futures falling 0.2% to 23,039.25 points during Asian trading hours.

Strategic Insights

TSMC’s robust financial performance underscores the semiconductor industry’s transformation toward AI-focused production. High-Performance Computing, primarily AI chips, now accounts for 59% of the company’s total sales, while advanced nodes at 7nm and below comprise 73% of revenue.

The company’s strategic investments position it for sustained growth, with plans to double CoWoS packaging capacity in 2025 and a $100 billion manufacturing expansion including major Arizona projects. This positioning proves critical as tech giants increasingly rely on TSMC’s advanced 3nm and 5nm chip production capabilities.

Australia emerges as the region’s standout performer, with the ASX 200 climbing 0.7% near all-time highs. Weaker employment data strengthens expectations for additional Reserve Bank of Australia rate cuts, benefiting interest-sensitive sectors and cyclical stocks.

Expert Opinions and Data

Chris Weston, head of research at Pepperstone, notes that Netflix will need to “blow the lights out” with its Thursday earnings report, given its outperformance versus the S&P 500. The streaming giant’s results will provide additional insight into consumer spending patterns amid economic uncertainty.

Macquarie analysts forecast continued strength in Australian equities, citing anticipated global interest rate reductions that particularly benefit technology and cyclical stocks. The positive outlook reflects broader expectations for monetary easing across major economies.

TSMC maintains gross margins of 57-59% despite rising costs and currency headwinds, demonstrating strong pricing power. The company projects first-half revenue growth of 40% to $60.8 billion, with earnings per share expected to increase 56-60% year-over-year to $2.37.

Conclusion

Asian markets remain caught between competing forces of strong corporate earnings and persistent geopolitical uncertainties. TSMC’s exceptional performance highlights the AI revolution’s financial impact, while broader market sentiment reflects ongoing concerns about trade policy and central bank actions.

The semiconductor sector’s mixed signals underscore the complexity facing investors, with strong current demand offset by longer-term growth concerns. Regional markets continue to navigate this environment with cautious optimism, as Australia’s outperformance demonstrates the potential for selective strength amid broader uncertainty.