- Earnings

- Quantum & Chips

- Stock Market

Texas Instruments Beats Earnings but Falls on Soft Outlook

5 minute read

Semiconductor giant Texas Instruments faces investor skepticism over cautious revenue guidance despite exceeding quarterly earnings targets

Key Takeaways

- Texas Instruments stock drops 7% in after-hours trading despite beating Q2 2025 earnings expectations with $1.41 per share versus $1.35 expected and revenue of $4.45 billion.

- Q3 2025 revenue guidance falls short of investor expectations with projected range of $4.45-4.8 billion, creating uncertainty amid tariff concerns and industrial market volatility.

- Analog chip segment drives 18% year-over-year growth to $3.5 billion, while the company invests $1.3 billion in quarterly capex as part of $60 billion facility expansion plan.

Introduction

Texas Instruments faces investor skepticism despite delivering strong second-quarter results, as the semiconductor giant’s cautious outlook overshadows robust financial performance. The company reported earnings per share of $1.41, beating analyst expectations of $1.35, while revenue reached $4.45 billion compared to the anticipated $4.36 billion.

The market’s negative reaction centers on concerns about sustainability of demand recovery and potential impacts from U.S. tariff policies. TI’s stock declined more than 7% in after-hours trading, reflecting investor unease about forward guidance and management’s increasingly conservative tone during the earnings call.

Key Developments

Texas Instruments delivered solid Q2 2025 results with revenue increasing 16% year-over-year from $3.82 billion. Net income rose 15% to $1.3 billion, or $1.41 per share, compared to $1.13 billion or $1.22 per share in the prior year period.

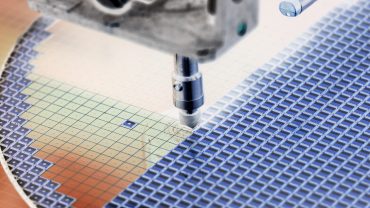

The analog chip business, TI’s largest segment, generated $3.5 billion in revenue, representing an 18% year-over-year increase and exceeding StreetAccount estimates of $3.39 billion. The embedded processing division contributed additional growth with a 10% year-over-year increase, while the data center segment expanded over 50%.

According to CNBC, management provided Q3 2025 guidance with earnings projected between $1.36 and $1.60 per share, compared to analyst expectations of $1.50 per share. Revenue guidance of $4.45 billion to $4.8 billion, with a midpoint of $4.625 billion, slightly exceeded analyst projections of $4.59 billion but failed to inspire confidence.

Market Impact

The semiconductor sector shows mixed signals as investors weigh strong current performance against uncertain future demand patterns. TI shares had gained 15% year-to-date before the earnings announcement, benefiting from broader market optimism surrounding chip stocks.

Trading at approximately 35 times forward earnings, Texas Instruments commands a premium valuation relative to the SOX semiconductor index and S&P 500. This elevated multiple reflects investor confidence in the company’s long-term manufacturing strategy but leaves limited margin for execution errors.

Analyst reactions demonstrate divided sentiment across Wall Street. The stock’s after-hours decline signals that investors prioritize forward-looking indicators over historical performance in the current market environment.

Strategic Insights

Texas Instruments operates in a complex environment characterized by nascent industrial market recovery and continued volatility in automotive and Chinese sectors. The company’s exposure to approximately 20% of revenue from China creates additional uncertainty amid evolving U.S. trade policies.

Management’s cautious approach reflects broader semiconductor industry dynamics, where companies balance robust near-term profitability with longer-term supply chain stability concerns. TI’s $1.3 billion quarterly capital expenditure and $4.9 billion annual investment underscore the industry’s capacity expansion requirements.

The company’s $60 billion investment in Texas and Utah facilities positions TI for domestic manufacturing growth but requires sustained demand to justify the substantial capital commitment. Geopolitical tensions and potential tariff changes under Section 232 framework add complexity to demand forecasting and customer ordering patterns.

Expert Opinions and Data

Analyst perspectives reveal divergent views on TI’s trajectory and valuation sustainability. TDCowen upgraded the stock to Buy with a $245 price target, citing the conclusion of industrial destocking cycles and the company’s strategic capital expenditure flexibility.

Seaport adjusted their rating to Neutral, acknowledging their previous bearish stance on analog inventory risk proved overly pessimistic. However, Morgan Stanley and Jefferies maintain more guarded outlooks, suggesting Q4 concerns may overshadow positive Q2 results.

During the conference call, executives faced scrutiny from analysts who characterized management’s tone as increasingly negative. Concerns about potential “pull-ins,” where customers accelerate orders ahead of anticipated tariff changes, could distort demand patterns and complicate forecasting accuracy.

The company returned $6.7 billion to shareholders through dividends and buybacks over the past year, demonstrating commitment to capital allocation while maintaining substantial reinvestment in manufacturing capabilities.

Conclusion

Texas Instruments’ Q2 2025 performance demonstrates the resilience of analog and embedded semiconductor markets, but investor focus has shifted toward sustainability and risk management. The company’s conservative guidance reflects prudent planning amid supply chain uncertainties and cyclical industry dynamics.

Market reaction emphasizes the premium placed on forward-looking confidence in today’s semiconductor landscape. TI’s elevated valuation and substantial capital investments require continued execution and demand recovery to maintain investor support in an increasingly scrutinized sector.