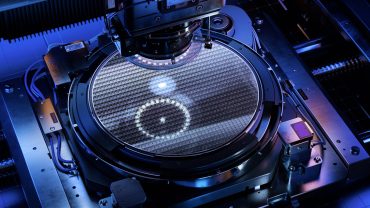

Semiconductor inventory buildup forces major European wafer manufacturer to abandon ambitious growth targets amid mobile sector slowdown

Key Takeaways

- Citi downgrades European chip wafer makers with Soitec cut to “sell” from “neutral” and price target reduced to €40 from €58, while Siltronic drops from “buy” to “neutral”

- Soitec withdraws fiscal forecasts including its $2bn revenue target with 40% EBITDA margin amid 20% revenue decline expected in Q1 2026

- Inventory levels surge to 14 months in Soitec’s RF-SOI segment, significantly above pre-pandemic norms of 6-9 months

Introduction

European semiconductor wafer manufacturers face mounting pressure as inventory challenges and weakening demand trigger analyst downgrades. Citi Research downgraded both Soitec and Siltronic this month, citing deteriorating market conditions across mobile and automotive segments that represent the bulk of their revenue streams.

The downgrades reflect broader industry concerns about oversupply and reduced visibility in key end markets. Soitec’s mobile business, expected to comprise 61% of fiscal 2025 revenue, confronts stagnant smartphone sales growth while automotive revenue faces a projected 45% decline in fiscal 2026.

Key Developments

Citi’s assessment highlights specific weaknesses across Soitec’s core segments. The RF-SOI inventory buildup to 14 months exceeds healthy levels by more than 50%, while the company’s target reduction to 11 months faces skepticism from analysts about sustainability.

Soitec’s automotive segment shows the most dramatic deterioration. First-quarter automotive revenue dropped to an estimated €3 million, down from the typical €30-45 million range. The company attributes this decline to elevated customer inventory levels and weakened electric vehicle demand.

The SmartSiC program, crucial for electric vehicle applications, encounters delays from slow EV adoption and lengthy qualification processes. Despite having six customers in qualification and 35 in evaluation, increasing Chinese competition and pricing pressures complicate growth prospects.

Market Impact

Soitec’s strategic pivot includes withdrawing medium-term financial guidance and shifting to quarterly revenue forecasts. The company abandons its $2bn revenue target with nearly 40% EBITDA margin, signaling diminished confidence in near-term recovery.

Capital expenditure cuts reflect the challenging environment, with Soitec reducing spending to €150m from €230m in fiscal 2025. The Imager-SOI product line phase-out eliminates $25m in quarterly revenue, contributing to the anticipated 20% year-over-year decline.

Siltronic faces similar pressures with flat sales projections and EBITDA margins of 21-25%. According to Investing.com, Citi’s revised price target of €44 from €57 reflects reduced confidence in the company’s ability to meet consensus estimates.

Strategic Insights

The semiconductor wafer industry confronts structural challenges beyond cyclical demand fluctuations. Soitec’s mobile segment faces headwinds from consumer shifts away from premium smartphones, potentially reducing demand for high-margin substrates.

Chinese competition intensifies across multiple segments, particularly affecting Siltronic’s 200mm and 300mm wafer businesses. The company’s planned exit from the 150mm segment by 2025 due to poor margins demonstrates the pressure on lower-value products.

Siltronic’s focus on power-oriented wafers rather than AI-related nodes constrains growth relative to competitors positioned for artificial intelligence demand. This strategic positioning becomes increasingly important as AI applications drive semiconductor requirements.

Expert Opinions and Data

Soitec CEO Pierre Barnabé maintains confidence despite current challenges. “We remain confident in our solid fundamentals and in our ability to accelerate growth as soon as our end markets begin to recover,” he states, emphasizing technology megatrends including 5G, energy efficiency, and AI.

The company projects addressable market expansion from five million wafers in 2024 to 12 million by 2030, based on 200mm equivalent measurements. This growth assumption underpins long-term investment plans totaling €770m.

Siltronic CEO Dr. Michael Heckmeier acknowledges limited visibility on inventory recovery. “The start of the year was within expectations. However, visibility remains limited on when our customers’ inventories will recover and thus demand for wafers will increase,” he comments.

Citi’s analysis shows consensus EBITDA estimates exceed their projections by 7% for 2025 and 16% for 2026 for Siltronic, suggesting potential disappointment if market conditions persist.

Conclusion

European wafer manufacturers navigate a challenging period marked by inventory imbalances and weakening demand across key segments. The downgrades reflect analyst skepticism about near-term recovery prospects and companies’ ability to meet existing financial targets.

Both companies face strategic decisions about market positioning and investment priorities as competitive pressures intensify. The semiconductor industry’s current difficulties underscore the importance of technological differentiation and market timing in maintaining competitive advantage.