- Quantum & Chips

- Semiconductors

- Tariffs

Samsung Wins Apple Chip Deal and U.S. Tariff Exemption

5 minute read

Samsung smartphone chips gain strategic foothold as tech giant secures major Apple supply deal and favorable U.S. trade terms

Key Takeaways

- Samsung shares surge 3.2% following announcement of chip supply partnership with Apple and exemption from proposed 100% U.S. tariffs on semiconductors

- Apple commits additional $100 billion U.S. investment bringing total commitment to $600 billion over four years, with Samsung’s Texas facility producing next-generation iPhone image sensors

- Strategic shift from Sony dominance as Samsung challenges Sony’s 50% market share in image sensors through exclusive Apple partnership worth billions in potential revenue

Introduction

Samsung Electronics shares climb sharply as the South Korean tech giant secures a transformative chip supply agreement with Apple and receives favorable U.S. trade treatment. The partnership marks Apple’s strategic pivot away from Sony’s exclusive image sensor supply for iPhones, with Samsung’s Austin, Texas facility set to produce next-generation chips for Apple products.

This development represents a significant shift in global semiconductor supply chains and reflects broader industry trends toward U.S.-based manufacturing. The dual announcements underscore Samsung’s growing importance in Apple’s supply ecosystem and highlight evolving geopolitical dynamics in tech manufacturing.

Key Developments

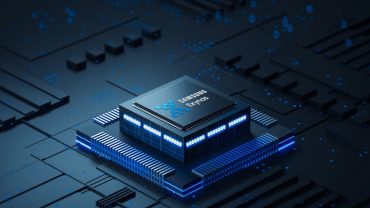

Apple announces it will source advanced image sensors from Samsung’s Texas-based production facility, ending Sony’s long-standing exclusive relationship for iPhone components. Samsung’s System LSI division will design and manufacture these sensors using proprietary ISOCELL technology and advanced two-wafer bonding processes.

The partnership forms part of Apple’s expanded $100 billion U.S. investment commitment, bringing the company’s total domestic spending pledge to $600 billion over four years. Production targets include over 19 billion chips for Apple products in 2025 alone.

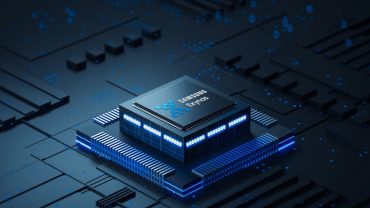

Simultaneously, South Korea’s trade envoy Yeo Han-koo confirms Samsung and SK Hynix will receive exemptions from proposed U.S. semiconductor tariffs. The companies will face reduced 15% duties instead of the initially proposed 25% rate, following recent trade negotiations between Seoul and Washington.

Market Impact

Samsung shares rise as much as 3.2% to 71,000 won in Seoul trading, reflecting investor optimism about the Apple partnership’s revenue potential. The stock movement demonstrates market confidence in Samsung’s ability to diversify beyond volatile memory chip markets.

The announcement follows Samsung’s recent $16.5 billion chip manufacturing agreement with Tesla, signaling the company’s success in securing major custom semiconductor contracts. These deals position Samsung to reduce operating losses in its semiconductor division, which has struggled with global oversupply and declining memory prices.

Competitor Sony faces pressure as its dominant 50% share of the global image sensor market comes under threat. Samsung currently holds 15.4% market share, but the Apple partnership could significantly narrow this gap in the high-value smartphone sensor segment.

Strategic Insights

The partnership reflects Apple’s broader supply chain diversification strategy, reducing dependence on single suppliers and geographic concentration. By establishing relationships with both TSMC in Arizona and Samsung in Texas, Apple creates redundancy in critical component manufacturing within U.S. borders.

Samsung benefits from reduced exposure to commodity memory markets through high-margin custom chip contracts. The Apple deal complements existing foundry relationships and strengthens Samsung’s position in advanced semiconductor manufacturing against competitors like TSMC.

The arrangement signals intensifying competition in premium semiconductor segments, where custom solutions command higher margins than standardized components. This trend favors companies with advanced manufacturing capabilities and strong customer relationships.

Expert Opinions and Data

Industry analysts view the partnership as strategically beneficial for both companies, with Apple securing robust U.S.-based supply chains while Samsung diversifies its client portfolio. According to The Financial Times, the deal represents a significant shift in semiconductor supply dynamics.

Market data reveals Sony’s vulnerability despite its current market leadership, as smartphone manufacturers increasingly seek supply chain resilience over single-source relationships. Samsung’s ISOCELL technology and two-wafer bonding capabilities position the company to compete directly with Sony’s premium offerings.

The tariff exemption reinforces U.S.-Korea technological cooperation, with reduced trade barriers encouraging further Korean investment in American manufacturing facilities. This development contrasts with ongoing U.S.-China tech tensions and export control measures.

Conclusion

Samsung’s dual victories in securing Apple’s chip business and favorable U.S. trade treatment mark a pivotal moment for the company’s semiconductor recovery strategy. The developments strengthen Samsung’s competitive position while advancing Apple’s supply chain localization objectives.

The partnership exemplifies broader industry shifts toward regional manufacturing hubs and strategic supplier diversification. These changes reshape competitive dynamics in premium semiconductors and signal continued evolution in global tech supply chains amid persistent geopolitical uncertainties.