Quantum Computing Stocks Surge After Nvidia CEO Declares 'Inflection Point'

5 minute read

Quantum Computing Stocks Rally as Nvidia Accelerates Development with New Boston Research Center and MIT Partnership

Three Key Facts

- Quantum computing stocks surged in premarket trading with Quantum Computing Inc. rising 8.6%, IonQ gaining 4%, and Rigetti Computing climbing 4.1% following Nvidia CEO’s comments

- Nvidia establishes the NVIDIA Accelerated Quantum Research Center in Boston, partnering with Harvard and MIT to integrate quantum hardware with AI supercomputers

- The Defiance Quantum ETF has gained more than 10% year-to-date, reflecting growing investor confidence in quantum computing breakthroughs

Introduction

Quantum computing stocks experienced significant gains in premarket trading Wednesday after Nvidia CEO Jensen Huang declared the technology has reached an “inflection point.” The semiconductor giant’s leader made these remarks at the VivaTech conference in Paris, sparking immediate optimism across the quantum sector.

Huang’s comments represent a notable shift from his previous stance. In January, he suggested practical quantum computers remained two decades away. His updated perspective signals accelerated progress within the quantum computing industry and highlights the technology’s potential to solve complex problems beyond current AI capabilities.

Key Developments

Multiple quantum computing companies saw their shares rise following Huang’s announcement. Quantum Computing Inc. led the gains with an 8.6% increase, while IonQ climbed 4% and Rigetti Computing advanced 4.1%. D-Wave Quantum gained 2.6%, and Arqit Quantum rose 2.7%.

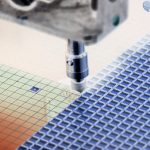

Nvidia has established the NVIDIA Accelerated Quantum Research Center in Boston, marking a strategic expansion into quantum research infrastructure. The facility operates in collaboration with Harvard and MIT scientists, positioning Nvidia at the center of quantum innovation through academic partnerships.

The company’s approach focuses on enabling infrastructure rather than manufacturing quantum hardware directly. Nvidia positions itself as the “accelerator” of quantum computing, providing foundational technologies and software platforms essential for industry advancement.

Market Impact

Quantum-related investments have attracted substantial capital this year. The sector benefits from growing institutional confidence, evidenced by the Defiance Quantum exchange-traded fund’s performance. The ETF has gained more than 10% year-to-date through Tuesday’s close.

Nvidia’s quantum initiatives complement its AI business, creating synergies between classical accelerated computing and emerging quantum technologies. The company’s CUDA-Q platform and associated libraries generate recurring revenue through quantum software development and simulation services.

International investment continues to flow into quantum research. The UK government plans to invest approximately £1 billion in AI research compute by 2030, demonstrating the significant capital commitment governments are making to quantum and AI technologies.

Strategic Insights

Nvidia’s quantum strategy emphasizes systems-level partnerships over hardware competition. This approach allows the company to maintain its central role in technological advancement while avoiding direct competition with specialized quantum hardware manufacturers.

The integration of quantum hardware from leading companies with Nvidia’s AI supercomputers creates a comprehensive ecosystem. This collaborative model addresses the technical challenges inherent in quantum computing development while leveraging existing AI infrastructure investments.

Huang emphasizes quantum computing’s capability to tackle problems requiring years of processing time on current AI systems. This potential represents a significant computational advantage for complex problem-solving across various industries and research applications.

Expert Opinions and Data

According to Investing.com, Huang’s comments have ignited sector-wide optimism. Industry observers view Nvidia’s strategic pivot as pragmatic, ensuring continued relevance in quantum advancement while maintaining focus on core competencies.

The quantum computing landscape has seen additional validation from major technology companies. Microsoft unveiled its Majorana 1 chip in February, claiming reduced error rates compared to competing technologies. These developments contribute to growing industry confidence in quantum computing’s commercial viability.

Market analysts highlight the ecosystem-driven approach as essential for addressing quantum computing’s technical challenges. The collaborative model between hardware manufacturers, software developers, and research institutions creates the comprehensive infrastructure necessary for quantum technology advancement.

Conclusion

Nvidia’s renewed optimism about quantum computing timeline has energized investor sentiment across the sector. The company’s infrastructure-focused strategy, combined with strategic academic partnerships, positions it to benefit from quantum advancement without direct hardware competition.

The positive market response demonstrates growing confidence in quantum computing’s commercial potential. Multiple companies have experienced significant stock gains, reflecting investor belief that practical quantum applications may arrive sooner than previously anticipated.