- Earnings Season

- S&P 500

- Stock Market

Palantir Q2: AI Boosts Revenue 39% as Commercial Sales Surge

6 minute read

Palantir’s AI platform fuels 71% commercial revenue surge as defense contractor expands into enterprise markets

Key Takeaways

- Stock doubles in 2025: Palantir Technologies shares have surged 100% this year, reaching an all-time high of $158 in August as the company expands from defense contracts into commercial AI applications.

- $10 billion Army contract secured: The data analytics company strengthened its defense portfolio with a major U.S. Army deal in July 2025, alongside a $795 million Maven Smart System contract, solidifying its government revenue base.

- Commercial revenue jumps 71%: U.S. commercial segment growth accelerated dramatically in Q1 2025, driven by AI platform adoption among clients including Fannie Mae, Walgreens, and Morgan Stanley.

Introduction

Palantir Technologies emerges as a standout performer in the AI sector this year, with shares doubling in value as the company transforms from a defense-focused operation into a commercial data analytics powerhouse. The stock currently trades at $154.86 per share, reflecting strong investor confidence in the company’s ability to capitalize on artificial intelligence demand across government and enterprise markets.

Founded in 2003 by Peter Thiel, Palantir has successfully diversified beyond its original intelligence community roots. The company now serves major commercial clients through its Foundry platform while maintaining critical defense relationships via its Gotham system.

Key Developments

Palantir’s transformation accelerated significantly in 2025, marked by substantial contract wins and commercial expansion. The company secured a $10 billion U.S. Army contract in July, representing one of the largest deals in its history.

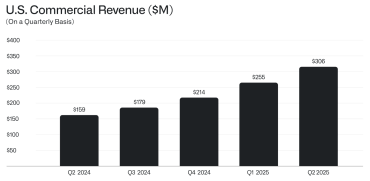

The commercial segment shows particular momentum, with U.S. commercial revenue growing 71% year-over-year in Q1 2025. This growth stems from widespread adoption of the company’s AI Platform (AIP), which delivers predictive analytics and operational efficiencies to enterprise clients.

Key partnerships now span multiple industries, including energy optimization work with BP, supply chain analytics for Airbus, and pharmaceutical development projects. These relationships demonstrate Palantir’s ability to apply its data analysis capabilities beyond traditional government surveillance applications.

Market Impact

The stock has recorded positive trading sessions in 14 of the past 30 days, with daily volatility averaging 4.64%. Trading volume remains elevated as institutional investors reassess the company’s commercial potential.

Palantir’s market capitalization expansion reflects broader investor enthusiasm for AI-focused companies. The stock’s performance outpaces many technology sector peers, driven by concrete revenue growth rather than speculative positioning.

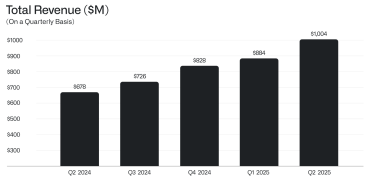

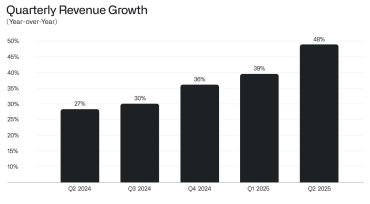

The company’s financial metrics support the market rally, with Q1 2025 total revenue reaching $3.9 billion, representing 39% year-over-year growth. U.S. revenue specifically jumped 55%, indicating strong domestic market penetration.

Strategic Insights

Palantir’s dual-market strategy positions the company to benefit from both increased defense spending and enterprise digital transformation initiatives. The AI software platform market is projected to grow at 41% annually through 2028, creating substantial runway for continued expansion.

The company maintains nearly $1 billion in cash and $4.4 billion in total assets, providing financial flexibility for research and development investments. This capital position enables aggressive product development while supporting sales efforts in competitive commercial markets.

Regulatory considerations present both opportunities and risks. Current political dynamics favor the company’s government surveillance capabilities, though potential policy shifts could impact future contract renewals.

Expert Opinions and Data

Analyst sentiment remains mixed despite the strong stock performance. Among 25 analysts covering the stock, most maintain “hold” ratings with price targets ranging from $100.39 to $178.

Industry observers highlight the company’s technological differentiation as a key competitive advantage. Forbes analysis suggests Palantir’s AI integration represents a potential “iPhone moment” for enterprise data analytics, though execution risks remain significant.

Revenue projections indicate the company could reach $20-25 billion in annual sales by 2030 if current growth rates persist. However, competitive pressure from Microsoft, AWS, and Google Cloud poses challenges to market share expansion.

Some optimistic forecasts suggest stock prices could reach $300 within five years, while conservative estimates point to $100-180 range depending on commercial market penetration success.

Conclusion

Palantir’s 2025 performance demonstrates successful execution of its commercial expansion strategy while maintaining strong government relationships. The company’s AI platform adoption and substantial contract wins validate its transition from niche defense contractor to broad-market data analytics provider.

Current financial metrics and market position support continued growth, though competitive dynamics and execution capabilities will determine long-term success. The stock’s elevated valuation reflects significant growth expectations that require sustained commercial momentum to justify investor confidence.