- Quantum & Chips

Nvidia Target Raised to $185 by Mizuho on Strong AI Chip Outlook

6 minute read

Semiconductor industry forecasts $697 billion revenue by 2025 as AI chip demand drives double-digit market growth

Key Takeaways

- Nvidia price target raised to $185 from $170 by Mizuho Securities, driven by anticipated Blackwell chip demand with up to 10,000 GB200 NVL72 units expected by Q4 and improved GPU supply conditions.

- Semiconductor industry revenues projected to reach $697 billion in 2025, representing 11% year-over-year growth with double-digit expansion continuing through 2026 amid AI-driven demand.

- Broadcom target increased to $315 as MTIA ASIC chip deployments by Apple and OpenAI by 2026 position the company to potentially surpass Nvidia GPU volumes with advanced packaging capabilities.

Introduction

Mizuho Securities has raised price targets across multiple semiconductor and AI server stocks, reflecting heightened market confidence in the sector’s growth trajectory. The firm cites improved supply dynamics and accelerating data center development as key drivers behind the optimistic outlook.

The upgrades come as the semiconductor industry prepares for what analysts expect to be a transformative period, with AI-driven demand reshaping competitive dynamics and revenue projections. Mizuho’s moves signal broader institutional confidence in the sector’s ability to sustain its recent momentum through 2025 and beyond.

Key Developments

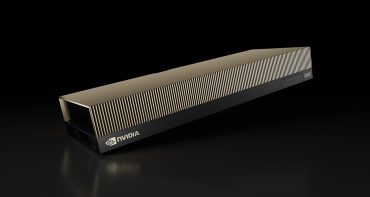

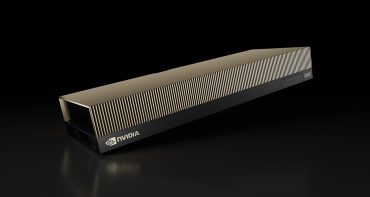

Nvidia leads the upgrade cycle with its price target lifted to $185 from $170, supported by expectations for Blackwell chip momentum in the second half of 2025. The company’s shares traded at $159.94, up 1.7% and setting a new 52-week high above $158.71.

Mizuho analyst Vijay Rakesh raised fiscal 2026 estimates to $202 billion in revenue and $4.38 earnings per share, up from previous projections of $195 billion and $4.16 EPS. The revision reflects improved GPU supply conditions and an earlier-than-anticipated launch timeline for Nvidia’s GB300 and air-cooled Rubin products.

The firm forecasts robust demand for Nvidia’s advanced chip architectures, with up to 10,000 units of the GB200 NVL72 expected for rack-level shipments by the fourth quarter. According to Investing.com, these projections underscore the accelerating pace of AI infrastructure deployment across major technology companies.

Broadcom receives a target increase to $315, fueled by expected deployments of its MTIA ASIC chips by Apple and OpenAI by 2026. Mizuho highlights Broadcom’s advanced packaging capabilities as maintaining approximately 12 months’ advantage over competitors in the custom silicon market.

Market Impact

The semiconductor sector demonstrates strong momentum with the forward price-to-earnings ratio climbing to 29.1, approaching previous peak levels. Nvidia shares have posted a 25% gain over the past year, while AMD stock has gained 13% over the past six months, trading at $138.28.

Industry margins improved from 23.5% to 28.6% in 2024, with fabless companies like Nvidia and Broadcom leading profitability gains due to AI and cloud demand. The sector’s market capitalization concentration reflects this performance, with Nvidia and Broadcom together holding over 80% of the S&P 500 Semiconductor index market cap.

Capital expenditure across the industry reaches approximately $185 billion in 2025, supporting manufacturing capacity expansion of 7%. This investment level reflects sustained confidence in demand growth despite elevated valuations and geopolitical uncertainties.

Strategic Insights

The upgrades highlight the industry’s shift toward Application-Specific Integrated Circuits and custom accelerators tailored for AI workloads. This transition strengthens competitive differentiation and creates deeper integration opportunities with end-user applications across multiple sectors.

Mizuho identifies the surge in “reasoning models” such as agentic AI as a significant growth driver, with these applications demanding 10-12 times more computational tokens than non-reasoning models. This trend supports continued GPU and ASIC compute expansion through 2026 and beyond.

The firm’s analysis points to potential market share shifts, with ASIC shipments positioned to surpass traditional GPU volumes by 2026. This development underscores the growing importance of specialized silicon solutions in meeting diverse AI computational requirements.

Expert Opinions and Data

Multiple research firms have joined Mizuho’s optimistic stance, with Rosenblatt Securities setting a $200 price target for Nvidia and Truist Financial raising their objective to $210. These moves reflect widespread analyst confidence in the sector’s growth prospects.

Industry executives maintain bullish outlooks, with 92% expecting revenue growth in 2025 and nearly half predicting more than 10% growth for their companies. This sentiment aligns with Mizuho’s projections for semiconductor revenues to climb 26.5% in 2025 and 18.9% in 2026.

The Internet of Things semiconductor market supports this optimism, with projections showing 19% compound annual growth rate reaching $80 billion by 2025. This expansion stems from innovations in low-power, long-range chips and AI-enabled devices across industrial and consumer applications.

Conclusion

Mizuho’s comprehensive target raises across the semiconductor sector reflect fundamental shifts in AI demand and supply chain dynamics. The upgrades signal institutional confidence in the industry’s ability to sustain growth momentum despite elevated valuations and ongoing geopolitical risks.

The semiconductor industry stands positioned for continued expansion, supported by robust capital investment, improving margins, and accelerating adoption of specialized AI chips. Current market dynamics suggest sustained institutional and investor confidence in the sector’s long-term growth trajectory.