- AI

Nvidia and Samsung Invest $35 Million in Robotics Startup Skild

5 minute read

Tech Giants Bet on AI-Powered Robotics Future with Strategic Investment in $4.5B Startup Skild

Three Key Facts

- Nvidia is investing $25 million and Samsung $10 million in Skild AI’s Series B funding round, which values the robotics software startup at $4.5 billion

- Skild AI previously secured $300 million in Series A funding led by Lightspeed Venture Partners, Coatue, SoftBank Group, and Jeff Bezos’s Bezos Expeditions

- Major tech companies including Apple, Meta, Amazon, and Google are aggressively pursuing robotics investments, creating intense competition in the sector

Introduction

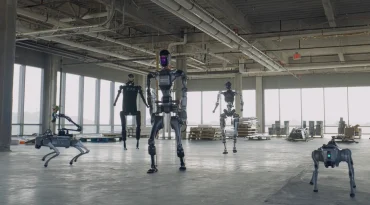

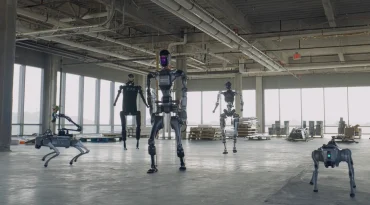

Samsung Electronics Co. and Nvidia Corp. are taking minority stakes in Skild AI Inc. to enhance their positions in the rapidly growing consumer robotics sector. The strategic investments represent a concerted effort by both technology giants to capitalize on advancements in consumer robotics and “physical AI.”

According to Bloomberg, Samsung is investing $10 million while Nvidia commits $25 million to the robotics startup. These moves reflect the increasing importance of robotics as a future growth driver in the technology industry.

Key Developments

Nvidia’s $25 million investment aligns with its broader push into “physical AI,” a term referring to robotics and autonomous vehicles as future revenue drivers. The chipmaker aims to leverage its strengths in semiconductors, software, and AI platforms to accelerate the development of intelligent, autonomous machines.

Samsung’s investment strategy focuses on staying competitive with other South Korean conglomerates. LG, Hanwha, and Mirae Asset have each invested $5–10 million in Skild AI, indicating a wider industry trend in Korea to maintain leadership in global robotics innovation.

Both companies are diversifying their robotics portfolios beyond Skild AI. Nvidia has invested in Figure AI and Serve Robotics, while Samsung holds stakes in other robotics startups including Physical Intelligence and maintains a major shareholding in Rainbow Robotics.

Market Impact

Skild AI’s Series B round, led by a $100 million investment from Japan’s SoftBank Group, demonstrates significant investor confidence in commercial robotics potential. SoftBank reportedly considered leading a $500 million round, highlighting the substantial capital flows entering the sector.

The high valuation reflects intense competition and optimism in robotics. Major technology companies are aggressively pursuing robotics opportunities, fueling a race for innovation and market share that extends across multiple industry segments.

Consumer and industrial robotics markets are experiencing rapid expansion. Samsung already markets robot vacuum cleaners and develops sophisticated products including humanoid robots and the Ballie home robot, which projects video in partnership with Google.

Strategic Insights

Skild AI’s foundation model serves as a shared, general-purpose brain for robots, covering tasks like manipulation, locomotion, and navigation. This approach represents a significant advancement in how robotics can be scaled across different applications and industries.

Both Nvidia and Samsung are building comprehensive ecosystems around robotics. Nvidia leverages its chip and AI expertise, while Samsung utilizes its consumer electronics and manufacturing capabilities to shape the intelligent machines market.

The minority stake approach allows both companies to gain exposure to emerging technologies and talent without assuming full control or risk. This strategy provides flexibility while maintaining strategic positioning in the evolving robotics landscape.

Expert Opinions and Data

Industry analysts view the investments from Nvidia, Samsung, and SoftBank as strong endorsement of robotics and AI as critical future growth areas. The $4.5 billion valuation for a software-focused robotics startup signals robust market confidence and high expectations for sector trajectory.

Samsung’s approach reflects both interest and strategic caution. The company reportedly views some aspects of Skild’s technology as less advanced than competitors, highlighting the fiercely competitive and fast-evolving nature of robotics development.

Nvidia’s “physical AI” strategy positions the company to benefit from the convergence of artificial intelligence, robotics, and autonomous vehicles. This positioning could prove particularly valuable as these technologies mature and integrate across various applications.

The robotics sector momentum extends beyond these specific investments. Tesla’s work on the Optimus robot and substantial investments from other technology giants underscore the sector’s transformative potential across multiple industries.

Summary

The strategic investments by Nvidia and Samsung in Skild AI represent significant moves in the competitive robotics landscape. With combined investments of $35 million as part of a $4.5 billion valuation, both companies position themselves in the growing physical AI market.

These investments demonstrate the technology industry’s commitment to robotics as a future growth driver. The minority stake approach allows both companies to participate in innovation while managing risk in this rapidly evolving sector.