- Digital Health

- Earnings Season

- HealthTech

Hims & Hers Shares Fall 11% Despite 73% Revenue Growth

5 minute read

Telehealth provider Hims & Hers struggles to meet Wall Street expectations despite digital revenue surge and subscriber growth

Key Takeaways

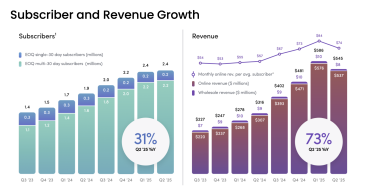

- Hims & Hers shares drop 11% to $56.25 in extended trading after Q2 revenue of $544.8 million missed analyst estimates of $552 million despite 73% year-over-year growth.

- Wholesale business unit declines 10% to $7.95 million year-over-year, while online revenue surges 75% to $537 million, highlighting the company’s digital-first transformation.

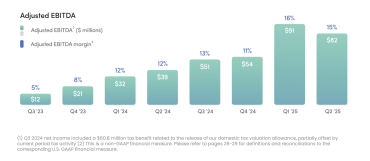

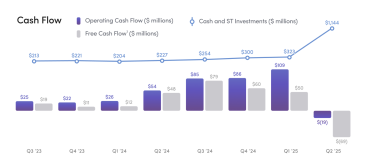

- Q3 revenue guidance of $570-590 million aligns with analyst expectations of $583 million, but full-year EBITDA guidance of $315 million falls short of $319.4 million consensus.

Introduction

Hims & Hers Health demonstrates how strong financial performance can still disappoint Wall Street when execution falls short of elevated expectations. The telehealth company’s shares tumbled 11% in after-hours trading despite reporting impressive 73% revenue growth and exceeding profitability targets.

The market reaction underscores investor sensitivity in the digital health sector, where companies face intense scrutiny over their ability to sustain rapid expansion. Despite year-to-date gains of 161%, Hims & Hers confronts the challenge of maintaining momentum amid regulatory headwinds and competitive pressures.

Key Developments

Hims & Hers reported Q2 revenue of $544.8 million, falling short of the $552 million analyst consensus, according to CNBC. The revenue miss stems primarily from weakness in the company’s wholesale business unit, which declined 10% year-over-year to $7.95 million.

The company’s core online business remains robust, generating $537 million in revenue with 75% year-over-year growth. This digital-first approach has driven subscriber growth to 2.4 million, representing a 31% increase from the previous year.

Profitability metrics exceeded expectations, with adjusted EBITDA reaching $82.2 million compared to analyst estimates of $73 million. Net income of $42.5 million and adjusted earnings per share of 17 cents both surpassed Wall Street projections.

Market Impact

The stock decline reflects investor concerns about the sustainability of Hims & Hers’ growth trajectory, particularly following recent regulatory challenges. Shares previously dropped over 30% in June after a failed collaboration with Novo Nordisk over compounded GLP-1 drug sales.

The market reaction also highlights broader skepticism toward digital health companies as post-pandemic tailwinds fade. Investors increasingly scrutinize companies’ ability to maintain elevated growth rates without compromising profitability margins.

Legal firms have issued class action reminders for investors who incurred losses, adding another layer of uncertainty to the stock’s near-term performance.

Strategic Insights

Hims & Hers’ performance illustrates the evolving dynamics in telehealth, where companies must balance rapid expansion with operational efficiency. The stark contrast between online revenue growth of 75% and wholesale decline of 10% signals a clear strategic pivot toward direct-to-consumer models.

The company’s recent acquisition of ZAVA Global expands its European presence and aims to generate at least $50 million in additional revenue. This international expansion represents a key growth driver as domestic market saturation becomes a concern.

Product diversification into longevity, hormone health, and weight management positions Hims & Hers to capture broader healthcare trends. However, regulatory scrutiny over compounded drug sales remains a significant operational risk.

Expert Opinions and Data

CEO Andrew Dudum emphasized the company’s progress in democratizing healthcare access, stating, “Our second-quarter results marked healthy progress against making personalized healthcare experiences a reality for millions of customers.” The subscriber base has maintained an average 43.3% year-over-year growth rate over the past two years.

Market analysts express mixed sentiment, with some viewing the selloff as an overreaction given the company’s strong underlying fundamentals. Others caution that the digital health sector faces increasing pressure to prove sustainable unit economics as venture capital funding tightens.

The company’s guidance suggests continued momentum, with Q3 revenue projections of $570-590 million closely matching analyst expectations of $583 million. Full-year revenue guidance of $2.3-2.4 billion maintains an aggressive growth trajectory.

Conclusion

Hims & Hers’ mixed quarterly results highlight the complex dynamics facing high-growth digital health companies. Strong operational metrics and profitability provide a solid foundation, yet execution gaps and regulatory uncertainties create investor anxiety.

The company’s ability to navigate these challenges while maintaining its growth trajectory will determine whether the current stock decline represents a temporary setback or a fundamental reassessment of its market position. The upcoming quarterly investor call at 5 p.m. ET will provide additional clarity on management’s strategic priorities.