- Industrial Strategy

- Quantum Computing

- State Capital

From Subsidies to Stakes: The State’s Quantum Shift

10 minute read

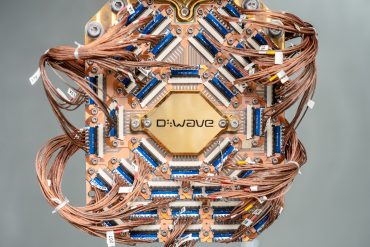

Washington shifts from grants to equity stakes in quantum firms as IonQ, Rigetti, and D-Wave rally; policy turns capital into industrial strategy.

Updated October 24, 2025 — The Trump administration has denied reports that it is negotiating for equity stakes in U.S. quantum computing companies. A Commerce Department official told CNBC there are “no ongoing discussions or proposals under consideration.”

Key Takeaways

-

Quantum equities rally on U.S. policy shift — IonQ rose 11.4 percent to $61.77, Rigetti jumped 17.97 percent to $42.54, and D-Wave gained 17.91 percent as investors priced in federal equity participation replacing traditional grants.

-

Defense Department’s Office of Strategic Capital outlines direct stakes — new framework allocates up to $1 billion across thirty-one critical technologies, with investments from $10 million to $150 million per firm tied to milestones and national-security returns.

-

Industrial strategy replaces subsidy model — equity infusions aim to de-risk commercialization in a $65 billion global quantum market by 2030, signaling Washington’s pivot from research patron to active shareholder in strategic technologies.

Market Signals

Washington’s relationship with quantum computing shifted this week, though the change arrived without fanfare. On October 23, three publicly traded quantum firms—IonQ (NYSE: IONQ), Rigetti Computing (NYSE: RGTI), and D-Wave Quantum (NYSE: QBTS)—posted double-digit gains as investors parsed signals that federal engagement may soon extend beyond research grants into direct equity participation. IonQ rose 11.4 percent to close at $61.77. Rigetti climbed nearly 18 percent to $42.54. D-Wave matched that trajectory at $32.19, its volume exceeding the daily average by more than 60 percent.

These movements reflect structural recalibration rather than speculative froth. They point to an emerging consensus in policy circles: that certain technologies carry strategic weight too significant to be left entirely to market forces, and that the tools of mid-century industrial policy—now refashioned for an age of algorithmic competition—may require revival. The mechanism under consideration, federal equity stakes, represents something more assertive than subsidy and less blunt than procurement. It positions the state not merely as patron but as investor, with returns measured in both national security and Treasury yield.

The Architecture of Intervention

The framework was erected quietly. The National Quantum Initiative, reauthorized last November through H.R. 6213, allocated just under $1 billion for fiscal year 2025. The sum represents a marginal decline from the prior year but sustains foundational research across the National Science Foundation, the Department of Defense, and the Department of Energy. Within that envelope: $260 million for NSF quantum information science programs, including the National Quantum Nanofab; over $100 million for defense applications in quantum inertial sensing; continued operation of five DOE-led National QIS Research Centers pursuing scalable qubit architectures. The Quantum Economic Development Consortium, now encompassing more than 250 institutional members, coordinates standardization in sensors and post-quantum cryptography.

Yet grants have reached their limit as instruments of acceleration. The quantum sector inhabits peculiar economic territory—capital-intensive, commercially unproven, strategically indispensable. Firms here routinely spend four dollars on research for every dollar earned. IonQ, employing just over 400, posted $37.5 million in revenue last year while absorbing operating losses exceeding $160 million in the second quarter alone. Annual burn rate approaches $200 million. Rigetti, headquartered in Berkeley, recorded $12 million in revenue against $198 million in R&D expenditure. D-Wave, the annealing specialist, reported second-quarter revenue of $10.1 million—up 50 percent year-over-year—but anticipates full-year losses near $120 million.

The Economics of Impatience

These trajectories are unsustainable without external intervention, and private capital has grown judicious. Venture investors, once abundant, now hesitate before protracted timelines to profitability, particularly in a field where error rates—currently one failure per thousand operations—still preclude most commercial deployment. Full fault-tolerance remains a decade distant. Meanwhile, strategic importance has only intensified. Quantum systems promise material advantages in molecular simulation, portfolio optimization, and cryptographic resilience. They also represent acute geopolitical exposure: dominance in quantum computing could render existing encryption obsolete, with cascading vulnerabilities across defense communications, financial networks, and critical infrastructure.

The Department of Defense’s Office of Strategic Capital, formalized in its January 2025 investment strategy, was designed precisely for this inflection point. Unlike traditional grants, which reimburse costs without securing ownership, equity investments would position the federal government as shareholder. The structure contemplates initial stakes beginning at $10 million per entity, performance-linked to qubit fidelity thresholds, integration with defense systems, and adherence to export controls. Returns would accrue to Treasury—not unlike sovereign wealth funds that marry strategic intent with financial discipline.

Corporate Realities

The precedent draws from the CHIPS and Science Act, which committed $39 billion to revive domestic semiconductor manufacturing. That program, however, relied on incentives rather than ownership. Federal equity represents a more muscular posture, one that could accelerate consolidation in a fragmented ecosystem. Over 1,600 quantum projects have received NQI funding since 2018, distributed across 180 startups and 117 academic institutions. The dispersion reflects experimental vigor but also inefficiency. Equity-linked capital imposes selection pressure, rewarding technical achievement while permitting weaker entrants to exit or merge.

For the companies in question, the logic is compelling. IonQ projects bookings between $82 million and $100 million this year, driven by cloud-based quantum access and pharmaceutical partnerships. Its trapped-ion architecture recently achieved two-qubit gate fidelity of 99.99 percent—a meaningful threshold. Yet the firm trades at 45 times forward sales, a valuation reflecting both first-mover advantage and exposure to dilution. Rigetti’s superconducting processors, priced at $5.7 million per unit, target hybrid quantum-classical applications in logistics and materials science. Early pilots with Lockheed Martin demonstrated 20 percent efficiency gains in route optimization. D-Wave’s annealing systems, integrating over 5,000 qubits, have delivered measurable improvements in supply-chain modeling for clients including Los Alamos National Laboratory.

All three operate with cash reserves insufficient for near-term ambition. Federal equity would furnish non-dilutive capital, extending runway without burdening existing shareholders. It would also confer validation—signaling that these firms have survived rigorous technical and strategic review. For institutional investors, that imprimatur carries weight. Quantum computing remains speculative, with beta coefficients above two that amplify broader volatility. A federal stake hedges not technological risk, which remains substantial, but the risk of policy abandonment.

Governance and Precedent

The complications merit scrutiny. State capitalism, even in democratic contexts, introduces governance friction. The Federal Funding Accountability and Transparency Act mandates conflict-of-interest protocols, and the OSC’s criteria—20 percent internal rates of return aligned with national security imperatives—may favor certain architectures over others. Trapped-ion systems suit defense applications better than annealing platforms, potentially skewing allocation. Historical episodes of directed funding, from aerospace to photovoltaics, offer cautionary evidence of innovation capture and rent extraction.

Yet the alternative carries greater cost. China’s quantum investments, underwritten by state capital and unburdened by equivalent regulatory constraint, have produced a formidable patent portfolio. The United States retains leadership in academic publications and fundamental research, contributing roughly 40 percent of global output in quantum information science. But publication counts translate imperfectly into commercial or military advantage. The distance between laboratory demonstration and operational deployment remains vast, and bridging it demands sustained capital at scale that private markets alone may not furnish.

Strategic Arithmetic

Federal equity stakes in quantum computing thus mark deliberate departure from orthodoxy. They acknowledge that certain technologies generate externalities—security, resilience, strategic autonomy—that private investors cannot fully monetize. Success depends on execution: disciplined investment criteria, transparent governance, tolerance for failure. The quantum sector will not yield linear returns. Error correction may arrive late. Commercial applications may prove narrower than projected. Some firms will founder.

But for policymakers navigating great-power competition, and for investors assessing multi-decade portfolio construction, the cost of inaction likely exceeds the cost of engagement. This is not enthusiasm but arithmetic. China’s quantum apparatus operates without the constraints of quarterly earnings or venture fund lifecycles. It allocates capital across decades, not deal cycles. The United States, to preserve leadership in a technology with implications spanning cryptography to drug discovery, requires instruments that transcend conventional venture logic.

The market movements this week suggest that calculation is already underway. What remains uncertain is whether execution will match ambition—whether the Office of Strategic Capital can deploy equity with the rigor of private investors and the patience of strategists. The answer will shape not only quantum computing’s trajectory but the broader question of how democracies compete in industries where time horizons stretch beyond electoral cycles and market impatience.

The ledger, for once, is transparent. The stakes, both financial and strategic, are quantifiable. What follows will test whether the American state can function as investor without becoming distortion—channeling capital toward national interest while preserving the competitive dynamics that have historically driven innovation. It is industrial policy for the algorithmic age, and its success or failure will resonate well beyond quantum computing’s nascent market.