- Media & Entertainment

- Streaming

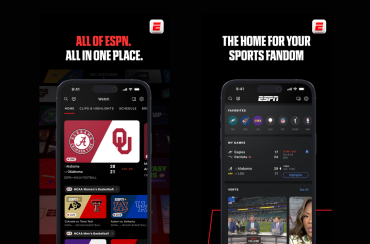

Disney Launches ESPN Streaming App at $29.99 for Sports Fans

5 minute read

ESPN streaming service brings live sports direct to consumers as cable subscriptions decline nationwide and viewing habits shift digital

Key Takeaways

- ESPN launches flagship streaming app at $29.99/month – Disney debuts its direct-to-consumer ESPN service Thursday, marking the first time all linear TV content is available via streaming

- Strategic partnerships expand content portfolio – ESPN secures WWE rights for $325 million annually and acquires NFL Network assets, with the NFL receiving 10% equity stake in ESPN

- Tiered pricing targets cord-cutting market – Two-plan structure offers unlimited access at $29.99 monthly or select tier at $11.99, with bundle options including Disney+ and Hulu

Introduction

Disney launches its new ESPN flagship streaming app Thursday, delivering the complete ESPN network suite directly to consumers for the first time. The service represents a fundamental shift in Disney’s distribution strategy as traditional cable subscriptions decline and streaming becomes the dominant viewing platform.

Current cable subscribers gain access through provider authorization, while cord-cutters can subscribe directly. The launch coincides with football season, positioning ESPN to capture viewers during peak sports consumption periods.

Key Developments

The streaming service offers two distinct tiers targeting different consumer segments. The unlimited plan provides access to all ESPN networks for $29.99 monthly, while the select plan costs $11.99 and includes ESPN+ content with over 32,000 live sports events annually.

Bundle options leverage Disney’s broader content ecosystem. Subscribers can combine ESPN unlimited with Disney+ and Hulu for $35.99 monthly, or access a promotional rate of $29.99 for the first year. The company also introduces bundles with Fox One launching in October and NFL+ beginning in September.

Authorization remains incomplete with select providers including Comcast Xfinity, YouTube TV, and Dish Network. These customers cannot access streaming-exclusive content until Disney resolves ongoing negotiations with their cable providers.

Market Impact

The $29.99 price point positions ESPN above most sports streaming competitors, reflecting its comprehensive live event portfolio of over 47,000 annual broadcasts. This premium pricing strategy targets higher average revenue per user compared to traditional cable carriage fees.

Disney+ added 1.8 million subscribers during its most recent quarter, reaching nearly 128 million global subscribers. The ESPN launch aims to accelerate streaming growth while maintaining revenue from declining cable subscriptions.

The service excludes some major cable providers at launch, potentially limiting initial subscriber acquisition. This creates immediate revenue risk as ESPN transitions from guaranteed cable fees to subscription-dependent streaming income.

Strategic Insights

Disney’s direct-to-consumer approach addresses cord-cutting trends that threaten traditional television revenue streams. According to The New York Times, the company positions streaming as essential for reaching younger demographics who consume sports content differently than cable subscribers.

Enhanced features differentiate the service from competitors through AI-driven personalization and multi-screen integration. “SportsCenter for You” generates custom content using anchor voices, while “StreamCenter” syncs mobile and television viewing experiences.

The WWE partnership signals ESPN’s commitment to premium content acquisition. The five-year, $325 million annual deal brings major wrestling events including WrestleMania to the platform starting in 2026, expanding beyond traditional sports programming.

Expert Opinions and Data

Disney CEO Bob Iger emphasizes generational strategy in the streaming transition. “The more ESPN can be present for a new generation of consumers with a product that serves them really well, the better off ESPN’s business is,” Iger stated during May earnings calls.

ESPN Chairman Jimmy Pitaro reinforces the platform’s accessibility mission. “This service and the enhanced ESPN App will deliver on that promise” to serve sports fans across all viewing platforms, Pitaro explains.

The NFL Network acquisition grants ESPN three additional NFL games while providing the league a 10% equity stake. This arrangement demonstrates ESPN’s willingness to share ownership for premium content access, where fans can sign up for the new service.

Conclusion

ESPN’s streaming launch represents Disney’s most significant step toward direct-to-consumer sports distribution. The premium pricing strategy tests consumer willingness to pay cable-level fees for streaming convenience and enhanced features.

Success depends on converting existing cable viewers while attracting cord-cutting sports fans. The service establishes ESPN’s foundation for future growth as traditional television viewership continues declining across all demographics.