- Quantum & Chips

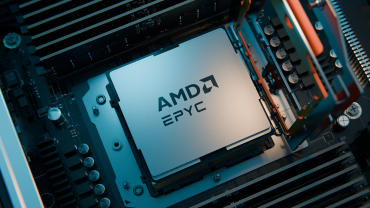

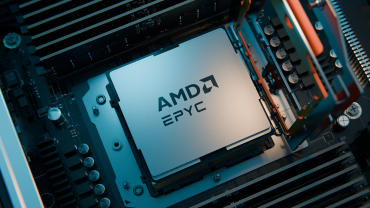

AMD Beats Earnings Targets Despite $700 Million Hit from China Export Limits

3 minute read

Chipmaker Shows Strong Data Center Growth and Client Gains Despite Export Restrictions Cutting China Revenue

Key Facts

- AMD reports Q1 revenue of $7.44 billion, exceeding expectations of $7.13 billion, with adjusted EPS of 96 cents

- Data center segment sales rose 57% to $3.7 billion, driven by AI graphics and Epyc processor demand

- Export restrictions to China projected to cost AMD $700 million in current quarter revenue

Introduction

AMD demonstrates resilience in its first fiscal quarter earnings despite facing significant headwinds from export restrictions to China. According to CNBC, while the company surpasses market expectations, new chip export limitations threaten to impact revenue by $700 million in the upcoming quarter.

Key Developments

The company’s data center segment emerges as a standout performer, with sales increasing 57% to $3.7 billion, powered by strong demand for Epyc processors and Instinct GPUs. AMD’s MI300X AI accelerators play a crucial role in the company’s strategy to compete with Nvidia in the AI data center market.

Export restrictions specifically targeting AMD’s MI308 and MI250 GPUs have forced the company to adapt its market approach. The impact could affect up to 175,000 GPUs, representing $1.4 billion in potential revenue. AMD plans to pursue export licenses while exploring alternative markets for affected inventory.

Market Impact

Client and Gaming segments show mixed results, with client revenue from laptop and PC chips rising 68%, while gaming sales decline 30%. The embedded segment, stemming from the Xilinx acquisition, shows a modest 3% decline to $823 million.

Investor response reflects market concerns, with AMD shares dropping 6-7% following the earnings announcement. The stock has declined approximately 17% year-to-date, prompting analysts to adjust their forecasts.

Strategic Insights

CEO Lisa Su addresses the challenges head-on, emphasizing the company’s strong product portfolio as a counterbalance to regulatory pressures. “While we face some headwinds from the dynamic macro and regulatory environments, they are more than offset by the powerful tailwinds from our leadership product portfolio,” Su states during the earnings call.

Expert Opinions and Data

Analysts maintain cautious optimism, with Deutsche Bank adjusting its target from $120 to $105 and Wedbush Securities revising from $150 to $115. The average analyst target price stands at $123.50, with a majority maintaining “buy” or “hold” ratings.

Major tech companies signal continued strong investment in AI infrastructure, with Meta Platforms, Microsoft, and Alphabet committing to significant capital expenditure ranging from $64-80 billion this year, suggesting sustained demand for AMD’s products.

Conclusion

AMD’s strong quarterly performance, highlighted by data center growth and client segment gains, demonstrates the company’s fundamental strength. While export restrictions pose immediate challenges, robust demand from major tech companies and AMD’s diverse product portfolio position the company to navigate current market conditions.