- Earnings Season

- Stock Market

- TravelTech

Airbnb Reports $2.3B Q2 Revenue, Expands AI as Stock Falls 6%

5 minute read

Airbnb reports strong Q2 revenue as AI customer service agents reduce human support by 15% and automation expands nationwide.

Key Takeaways

- Airbnb stock drops 6% in after-hours trading despite beating Q2 revenue expectations with $2.3 billion and announcing a $6 billion stock buyback, as the company signals slower Q3 growth ahead.

- CEO Brian Chesky commits to AI-first transformation with virtual agents capable of booking entire trips for users, positioning Airbnb as an “everything app” in the travel sector within the next couple of years.

- AI customer service reduces human contact by 15% as Airbnb’s automated agent handles more queries independently, with plans to expand the feature to all U.S. users this month.

Introduction

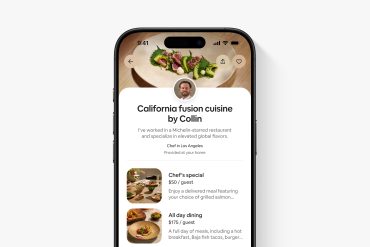

Airbnb announces a fundamental shift toward becoming an AI-first application where virtual agents book complete trips for users. CEO Brian Chesky reveals this strategic transformation during the company’s second-quarter earnings call, outlining plans to evolve Airbnb into an “everything app” powered by artificial intelligence.

The announcement comes as Airbnb reports mixed financial results. The platform surpasses revenue expectations with $2.3 billion in Q2 revenue, representing a 6% year-over-year increase, while simultaneously announcing a substantial $6 billion stock buyback program.

Key Developments

Chesky envisions a dramatic evolution in mobile applications over the next two years. Currently, almost none of the top 50 apps in the App Store focus on AI functionality, with OpenAI’s ChatGPT standing as a notable exception.

“Over the next couple of years, I think what you’re going to see is Airbnb becoming an AI-first application,” Chesky states during the earnings call. He predicts most successful apps will transform into AI-driven platforms, either through new startups or existing company evolution.

The company began rolling out its AI customer service agent in April, starting with 50% of U.S. users. This system handles customer queries without human intervention, focusing on service efficiency rather than travel planning like competitors.

Market Impact

Airbnb shares decline more than 6% in after-hours trading despite the positive revenue results and buyback announcement. The market reacts negatively to management’s guidance for slower growth in the third quarter.

Net income drops to $154 million from $264 million in the previous year, attributed to increased headcount, investment write-downs, and reduced interest income. The financial pressure reflects the company’s investment in AI infrastructure and expanded operations.

Competitors face similar AI investment pressures. Expedia and Booking.com deploy significant resources toward AI features including itinerary building and trip planning, while Booking Holdings increases social media marketing spend by 25% to counteract Google’s AI summaries.

Strategic Insights

Airbnb’s AI approach differs fundamentally from travel industry competitors. While others focus on trip planning and inspiration, Airbnb prioritizes customer service automation and personalized booking assistance.

The company leverages user profiles and behavioral data through what it calls “passports” to create tailored recommendations. This data-driven approach aims to deliver a “concierge in your pocket” experience that proactively assists with trip planning and booking decisions.

The platform recently removed 450,000 listings and introduced total price displays to address reliability concerns. More than 17 million guests have used the total price feature over two years, creating higher customer satisfaction and reducing service tickets.

Expert Opinions and Data

“We believe this is the best AI-supported customer travel agent in travel,” Chesky explains, emphasizing the system’s personalization capabilities. “It will not only tell you how to cancel your reservation, it will know which reservation you want to cancel.”

Chief Business Officer Dave Stephenson describes AI as an “incredibly high priority” at a recent Las Vegas conference. He notes that top management regularly discusses the “critical importance of AI” in the company’s long-term vision, stating that “it pervades everything we do.”

Research by PYMNTS Intelligence shows growing consumer expectations for generative AI assistance in travel planning. Kayak CEO Steve Hafner tells PYMNTS the company plans AI agents to facilitate complete bookings without requiring users to leave the platform. “With agentic AI, we can actually facilitate that without the consumer ever having to leave the Kayak experience,” Hafner explains.

Conclusion

Airbnb positions itself at the forefront of AI transformation in travel technology while managing near-term growth challenges. The company’s focus on customer service automation and personalized booking assistance distinguishes its approach from competitors pursuing trip planning solutions.

The platform’s commitment to AI-first functionality represents a fundamental shift in how users interact with travel booking services. Despite current market skepticism reflected in the stock decline, Airbnb’s substantial buyback program and AI investment signal management confidence in the strategic direction.