- Export Controls

- Geopolitics & Policy

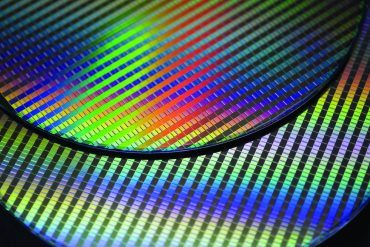

- Semiconductors

US Export Curbs Put $9.9B TSMC China Revenue at Risk

5 minute read

US export restrictions on TSMC’s China operations threaten $9.9 billion in semiconductor revenue as licensing rules tighten

Key Takeaways

- TSMC loses China shipping waiver – U.S. revokes validated end user status for Taiwan Semiconductor’s Nanjing facility effective December 31, 2025, requiring case-by-case approvals for equipment and materials shipments.

- $9.91 billion revenue at risk – TSMC’s Chinese business represents 11% of its $90.08 billion annual revenue, with the Nanjing plant accounting for 3% of total production capacity across 12nm, 16nm, and 28nm nodes.

- Semiconductor equipment stocks decline – Applied Materials and KLA shares drop alongside ASML depository receipts as suppliers face increased licensing uncertainty for China facility shipments.

Introduction

The U.S. has revoked Taiwan Semiconductor Manufacturing Co.’s authorization to freely ship essential equipment to its main Chinese chipmaking facility, marking a significant escalation in Washington’s tech restrictions on China. American officials recently informed TSMC of their decision to end the company’s validated end user status for its Nanjing site, effective December 31, 2025.

This move mirrors similar actions against Chinese facilities operated by Samsung Electronics and SK Hynix, reflecting Washington’s broader strategy to limit China’s semiconductor capabilities. The decision forces TSMC suppliers to seek individual U.S. approvals for shipments of manufacturing tools, spare parts, and production chemicals.

Key Developments

TSMC received formal notification that its VEU authorization for the Nanjing facility expires at year-end 2025. The company states it remains “fully committed to ensuring the uninterrupted operation of TSMC Nanjing” while evaluating the situation and communicating with U.S. officials.

The affected facility, known as Fab 16, produces chips using TSMC’s 12nm FinFET, 16nm FinFET, and 28nm production nodes. These semiconductors serve automotive, 5G RF, and consumer electronics applications that remain crucial for Chinese tech sectors.

Unlike Samsung and SK Hynix, whose VEU status was formally rescinded through published federal regulations, TSMC’s waiver was never listed in the federal register. However, the practical impact remains identical across all three companies.

Market Impact

Semiconductor equipment suppliers face immediate uncertainty as the policy shift eliminates blanket shipping approvals. Applied Materials and KLA shares decline in New York trading, while ASML depository receipts also drop as investors assess potential licensing delays.

The revocation affects approximately 1,000 additional permits annually that U.S. officials must process, according to federal notices. This adds to an existing backlog of license requests, raising concerns about approval timeframes for critical manufacturing supplies.

TSMC’s Chinese operations generated approximately $9.91 billion in 2024, representing 11% of the company’s total $90.08 billion revenue. While the Nanjing facility accounts for a modest 3% of TSMC’s production capacity, it serves strategic markets within China’s technology ecosystem.

Strategic Insights

The waiver revocation accelerates China’s push toward semiconductor self-sufficiency while creating opportunities for domestic foundries. Chinese competitors SMIC and Hua Hong stand to benefit if customers redirect production from TSMC’s constrained Nanjing facility to domestic alternatives.

TSMC faces complex decisions about equipment sourcing for its Chinese operations. While Chinese suppliers like AMEC, Kingsemi, Naura, and Piotech offer advanced cleaning, deposition, and etching tools, they lack complete toolsets for commercial-grade 16nm production.

The policy change demonstrates Washington’s expanding influence over global semiconductor supply chains, affecting non-American facilities through U.S. content requirements. This extends American export control reach beyond direct Chinese companies to foreign-operated plants within China.

Expert Opinions and Data

Taiwan’s Ministry of Economic Affairs acknowledges that the waiver revocation impacts operational predictability at the Nanjing plant. According to Fortune, officials work on solutions to ease bureaucratic burdens given the significant volume of license requests.

The Commerce Department’s Bureau of Industry and Security previously cited the need to close “export control loopholes” disadvantaging American companies when revoking Samsung and SK Hynix designations. However, BIS has not commented specifically on TSMC’s waiver revocation.

Industry analysts warn that prolonged export license delays could create business impacts similar to previous U.S. actions against Chinese tech firms. The uncertainty extends beyond individual companies to broader sectors including telecommunications, artificial intelligence, and consumer electronics.

Conclusion

The VEU revocation represents a fundamental shift from blanket approvals to case-by-case licensing for semiconductor equipment shipments to China. TSMC, Samsung, and SK Hynix now operate under identical constraints requiring proactive license applications for critical manufacturing supplies.

This policy change strengthens U.S. oversight of China’s semiconductor access while creating operational uncertainties for global chipmakers. The move reinforces Washington’s broader technology competition strategy and accelerates China’s domestic semiconductor development efforts.