- AI Adoption

- Data Centers

- Quantum & Chips

AMD Data Center Revenue Climbs to $12.6B Amid AI Growth

5 minute read

AMD’s data center revenue surges to $12.6 billion as major cloud providers accelerate AI hardware adoption

Key Takeaways

- AMD receives major upgrade to Buy rating from Truist Securities with price target raised to $213 from $173, driven by strong AI and data center performance

- Data center revenue surges 94% annually to $12.6 billion in 2024 as hyperscale customers increasingly deploy AMD solutions at scale

- AI stock valuations approach dotcom-era levels with U.S. tech trading above 35x P/E, raising sustainability concerns across the sector

Introduction

AMD secures a significant vote of confidence from Wall Street as analysts recognize the company’s transformation from Nvidia competitor to credible AI infrastructure partner. Truist Securities upgrades AMD to Buy rating with a $213 price target, marking a 23% increase from previous expectations.

The upgrade reflects AMD’s accelerating traction with hyperscale customers and sustainable market share gains in both server CPUs and GPUs. Analysts project the company will maintain a 10% GPU market share while targeting $7.89 earnings per share by 2027.

Key Developments

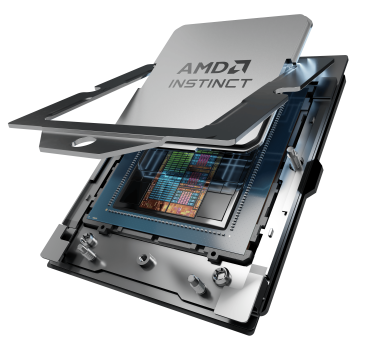

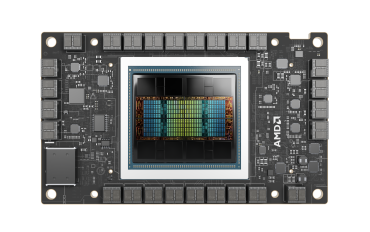

AMD’s strategic positioning centers on aggressive AI hardware expansion through its MI300 and MI350 GPU accelerators. Major cloud customers including Microsoft and Oracle are adopting these solutions for data center workloads, validating AMD’s competitive approach.

The company reinforces its AI capabilities through the $4.9 billion acquisition of ZT Systems, creating integrated hardware and software solutions. This acquisition positions AMD as a comprehensive AI infrastructure provider rather than a component supplier.

AMD establishes a quantum computing partnership with IBM, combining AMD processors with IBM’s quantum systems. This collaboration signals the company’s commitment to next-generation computing beyond traditional AI applications.

Market Impact

AMD reports record Q2 2025 revenue of $7.7 billion, representing 31.7% year-over-year growth with net income reaching $872 million. Data center revenue drives performance with $12.6 billion in 2024, a 94% increase over the previous year.

The stock rallies on the Truist upgrade, though broader AI sector valuations draw caution from analysts. Investing.com reports that hyperscale clients show increasing interest in deploying AMD solutions at larger scale, supporting the positive analyst sentiment.

UBS warns that AI stock valuations approach dotcom bubble levels with U.S. tech trading above 35 times earnings. This elevated pricing raises concerns about sustainability amid uncertainties over capital expenditure returns and competitive pressures.

Strategic Insights

AMD’s transformation from hardware vendor to AI ecosystem player reflects broader industry consolidation trends. The company’s open-source ROCm software stack gains traction as a cost-effective alternative to Nvidia’s proprietary CUDA platform.

Despite progress, Nvidia maintains 80-90% market share in AI data center GPUs compared to AMD’s 11% position. The competitive gap remains substantial, requiring continued execution on product development and customer acquisition.

Export restrictions to China and supply chain dependence on TSMC present material risks to AMD’s growth trajectory. These factors create vulnerability in an increasingly geopolitically sensitive semiconductor market.

Expert Opinions and Data

Truist analysts highlight AMD’s evolution in customer perception, noting the shift from competitor to genuine partner status. They project sustainable market share expansion based on improving product competitiveness and customer relationships.

Analysts forecast fiscal 2025 revenue of $33 billion, growing to $40.1 billion in 2026 for a 21.4% compound annual growth rate. Earnings per share projections rise from $3.90 in 2025 to $6.02 in 2026, representing 54% growth.

Bank of America downgrades Marvell Technology to Neutral, citing concerns over AI growth prospects in Microsoft and Amazon-related projects. This contrasts with AMD’s positive momentum and highlights varying AI sector trajectories.

RBC Capital Markets dismisses concerns that AI will eliminate traditional software companies, instead highlighting monetization opportunities. The firm anticipates merger and acquisition activity as companies navigate AI’s transformative impact.

Conclusion

AMD emerges as a credible AI infrastructure challenger through strategic acquisitions, customer partnerships, and product innovation. The company’s financial momentum supports analyst optimism, though elevated sector valuations and competitive risks demand careful evaluation.

The broader AI sector experiences valuation expansion reminiscent of historical technology bubbles, creating both opportunity and caution for investors. AMD’s positioning as a comprehensive AI solutions provider positions the company to capture market share while navigating industry transformation challenges.